Form 309R Credit for Taxes Paid to Another State or Country Instructions

INSTRUCTIONS: ARIZONA RESIDENT CREDIT FOR TAXES PAID TO ANOTHER STATE OR COUNTRY INSTRUCTIONS (Form 309-R)

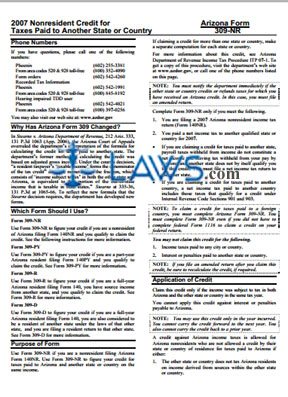

Arizona residents seeking credit for taxes paid to another state or country used a form 309-R for this purpose in 2007. This article discusses the separate instructions booklet for filing this form. Both the form and the instructions can be obtained from the website of the Arizona Department of Revenue.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 1: The left column of the first page contains phone numbers for further assistance with completing this form, explanations of the differences between forms 309-R, 309-D, 309-PY and 309-PR, and an explanation of the purpose of this form.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 2: The right column of the first page explains who must complete form 309-R, who is not eligible to do so, and how to apply the credit.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 3: The left column of the second page concludes instructions about eligibility for filing this form and which attachments are required.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 4: The right column of the second page has instructions for completing lines 1 through 3.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 5: The top half of the third page contains an example of how to complete lines 1 through 3.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 6: The bottom left column of the third page contains instructions for completing lines 4 through 12.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 7: The bottom right column of the third page contains instructions for completing lines 13a through 13e.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 8: The top half of the fourth page contains an example for how to complete lines 13a through 13e.

Arizona Resident Credit For Taxes Paid To Another State Or Country Instructions 309-R Step 9: The bottom half of the fourth page contains instructions for completing lines 15 through 19. The last page contains instructions for line 20 and a full chart of state abbreviations.