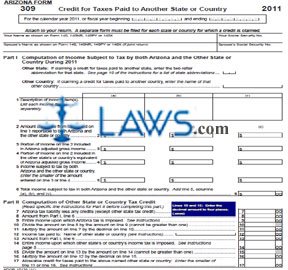

Form 309 Credit for Taxes Paid to Another State or Country

INSTRUCTIONS: ARIZONA CREDIT FOR TAXES PAID TO ANOTHER STATE OR COUNTRY (Form 309)

Form 309 is used to claim credit in Arizona for taxes paid to another state or country. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 2: In the first blank box, enter your name as it appears on form 140, 140NR, 140PY or 140X.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 3: In the second blank box, enter your Social Security number.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 4: In the third blank box, if filing a joint return, enter your spouse's name as it appears on form 140, 140NR, 140PY or 140X.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 5: In the fourth blank box, if applicable, enter your spouse's Social Security number.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 6: Part I concerns computation of income subject to tax by both Arizona and another state or country during the taxable year. If filing for a credit concerning tax paid to another state, enter its two-letter abbreviation. If filing for a credit concerning tax paid to another country, enter its name.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 7: On line 1, provide descriptions of all income items.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 8: Complete lines 2 through 6 as instructed to determine the total income subject to tax in Arizona and the other state or country.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 9: Part II concerns computation of your credit. On line 7, enter your Arizona tax liability less any credits except other state tax credits.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 10: On line 8, enter the value from line 6.

Arizona Credit For Taxes Paid To Another State Or Country 309 Step 11: Complete lines 9 through 17 as instructed to determine your allowable credit.