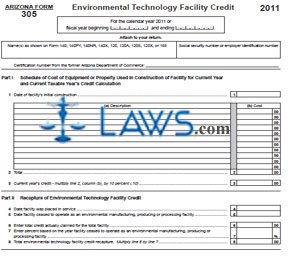

Form 305 Environmental Technology Facility Credit

INSTRUCTIONS: ARIZONA ENVIRONMENTAL TECHNOLOGY FACILITY CREDIT (Form 305)

In Arizona, form 305 is filed to claim credit for an environmental technology facility. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Environmental Technology Facility Credit 305 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Environmental Technology Facility Credit 305 Step 2: In the first blank box, enter your name as it appears on form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165.

Arizona Environmental Technology Facility Credit 305 Step 3: In the second blank box, enter your Social Security number or employer identification number.

Arizona Environmental Technology Facility Credit 305 Step 4: Enter your certification number from the former Arizona Department of Commerce.

Arizona Environmental Technology Facility Credit 305 Step 5: Part I requires to provide documentation of the cost of equipment or property used in the construction of the facility for the current years and to calculate the current taxable year's credit. On line 1, enter the date of the facility's initial construction.

Arizona Environmental Technology Facility Credit 305 Step 6: Provide a description and the cost of all equipment and property in the table provided. Enter the total cost on line 2.

Arizona Environmental Technology Facility Credit 305 Step 7: Multiply line 2 by 10% and enter the resulting product on line 3.

Arizona Environmental Technology Facility Credit 305 Step 8: Part II concerns recapture of the environmental technology facility credit. Complete lines 4 through 8 as instructed.

Arizona Environmental Technology Facility Credit 305 Step 9: Enter your name and tax identification number at the top of the second and third pages.

Arizona Environmental Technology Facility Credit 305 Step 10: Part III should be completed by S corporations only. If applicable, complete lines 9 through 13 as instructed.

Arizona Environmental Technology Facility Credit 305 Step 11: Part IV concerns each partner's share of the credit. Complete lines 14 through 17 separately for each partner as instructed.

Arizona Environmental Technology Facility Credit 305 Step 12: Part V is a summary of the credit recapture. Complete lines 18 through 23 as instructed.

Arizona Environmental Technology Facility Credit 305 Step 13: Part VI concerns the available credit carryover, while Part VII concerns the total available credit. Complete lines 24 through 42 as instructed.