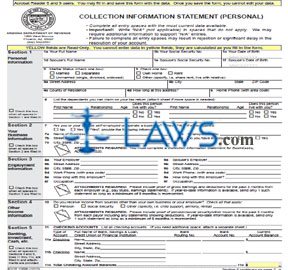

Form 10896 Collection Information Statement Personal

INSTRUCTIONS: ARIZONA COLLECTION INFORMATION STATEMENT (PERSONAL) (Form 10896)

In Arizona, form 10896 is used to file a personal collection information statement in tax collection proceedings. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Collection Information Statement (Personal) 10896 Step 1: Section 1 concerns your personal information. Enter your name, date of birth, Social Security number, marital status, address, dependents and all other requested information on lines 1 through 6.

Arizona Collection Information Statement (Personal) 10896 Step 2: Section 2 concerns your business information. Provide all information requested on lines 7 through 7c.

Arizona Collection Information Statement (Personal) 10896 Step 3: Section 3 concerns employment information. Provide all information requested on lines 8a through 9f.

Arizona Collection Information Statement (Personal) 10896 Step 4: Section 4 concerns other income information. Answer the question on line 10 with a check mark next to the applicable statement.

Arizona Collection Information Statement (Personal) 10896 Step 5: Section 5 concerns your banking, investment and related accounts. On lines 11 through 11c, provide all information requested about your checking accounts.

Arizona Collection Information Statement (Personal) 10896 Step 6: Document all other accounts on lines 12 through 12d.

Arizona Collection Information Statement (Personal) 10896 Step 7: Document investments on lines 13 through 13d.

Arizona Collection Information Statement (Personal) 10896 Step 8: Document your cash on hand on line 14.

Arizona Collection Information Statement (Personal) 10896 Step 9: Document your available credit on lines 15 through 15d.

Arizona Collection Information Statement (Personal) 10896 Step 10: Document your life insurance on lines 16 through 16f.

Arizona Collection Information Statement (Personal) 10896 Step 11: Section 6 concerns federal and other taxes owed. Complete lines 17 and 17a as directed.

Arizona Collection Information Statement (Personal) 10896 Step 12: Section 7 concerns other information. Complete lines 18 through 18h as instructed.

Arizona Collection Information Statement (Personal) 10896 Step 13: Section 8 concerns assets and liabilities. Complete lines 19 through 21g as instructed.

Arizona Collection Information Statement (Personal) 10896 Step 14: Section contains a monthly income and expense analysis. Complete lines 22 through 44 as instructed.

Arizona Collection Information Statement (Personal) 10896 Step 15: At the bottom of the fourth page, enter your signature on the first blank line and the date on the second blank line. If filing with your spouse, they should enter their signature and the date on the last two blank lines.