Form CA GP1 Statement of Partnership Authority

INSTRUCTIONS: STATEMENT OF PARTNERSHIP AUTHORITY CA GP1

This form is used to form a business partnership in the state of California. The individual filing this document needs to send copy to all other partners or any other person named in the form.

“Statement of Partnership Authority CA GP1 Step 1”

Enter the proposed name of the partnership in Item 1.

“Statement of Partnership Authority CA GP1 Step 2”

In Item 2, provide the address for the chief executive office for the general partnership. Use a street address. Do not use a P.O. Box address, and do not abbreviate the name of the city.

“Statement of Partnership Authority CA GP1 Step 3”

Only enter an address in Item 3 if the chief executive office for the general partnership is not located in the state of California. Do not use a P.O. Box number.

“Statement of Partnership Authority CA GP1 Step 4”

The individual filing this form must complete item 4 or 5. If item 4 is completed, provide the name and address of all the partners. If additional space is needed, provide a separate sheet. Leave item 5 blank if you fill out item 4.

If item 4 is left blank, fill out item 5. Provide the name and address for the partnership’s agent who will maintain a list of the names and mailing address for all partners.

“Statement of Partnership Authority CA GP1 Step 5”

Provide the names of all partners in item 6. If additional space is needed, provide a separate sheet with additional partner names.

“Statement of Partnership Authority CA GP1 Step 6”

Item 7 calls for any additional information in the form of an attachment.

“Statement of Partnership Authority CA GP1 Step 7”

Provide the signatures and printed names of all partners in item 8. If additional space is needed, attach a separate sheet including the signatures and printed names of all other partners.

“Statement of Partnership Authority CA GP1 Step 8”

The filing fees for this form are $70.00. If you submit the form in-person, there is an additional special handling fee of $15.00. If you’re submitting the form in-person, travel to the following address:

Sacramento Office

1500 11th Street, 3rd Floor

Sacramento, CA 95814

If you’re mailing the form, use the following address:

Secretary of State

Document Filing Support Unit

P.O. Box 944225

Sacramento, CA 94244-2250

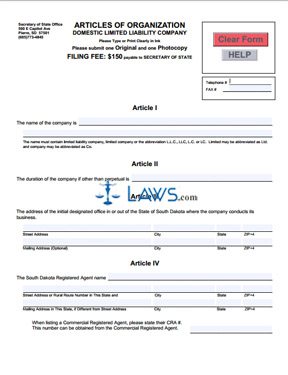

Form SD Articles of Organization (LLC)

INSTRUCTIONS: SD ARTICLES OF ORGANIZATION (LLC)

You can use this form to register a limited liability company in the state of South Dakota. Make sure to consult with an attorney or tax specialist before completing this form.

“SD Articles of Organization (LLC) Step 1”

Provide the proposed or reserved name of the limited liability company in Article I. Make sure the name contains one of the following designations: limited liability company, limited company, L.L.C., LLC, L.C., or LC.

“SD Articles of Organization (LLC) Step 2”

If the duration of the limited liability company is any less than perpetual, provide a specific date in Article II.

“SD Articles of Organization (LLC) Step 3”

List the street address of the designated office for the limited liability in Article III. If the mailing address is different, provide this address as well.

“SD Articles of Organization (LLC) Step 4”

Enter the name of the resident agent for the limited liability company in Article IV. Provide their street address and mailing address (if different than the street address). If the LLC has elected a commercial registered agent, provide the CRA number on the line provided.

“SD Articles of Organization (LLC) Step 5”

State the name and list the address of each organizer in Article V. Attach a separate sheet if more room is needed.

“SD Articles of Organization (LLC) Step 6”

Check the first box in Article VI if the LLC is member managed. Check the second box if the LLC is manager managed. Provide the names of the managers and their street addresses if the LLC is manager managed.

“SD Articles of Organization (LLC) Step 7”

If one or more of the members are liable for the debts and obligation of the limited liability company, provide the provisions in Article VII. If any other provisions are necessary, list the terms in VIII. If more space is needed, attach a separate form.

“SD Articles of Organization (LLC) Step 8”

All of the organizers need to sign the bottom of this form. They also need to provide their printed name, title, and date of signature.

“SD Articles of Organization (LLC) Step 9”

The filing fee is $150.00. Make the check payable to Secretary of State. Submit the completed original and duplicate to the following address:

Secretary of State Office

500 E Capitol Ave

Pierre, SD 57501

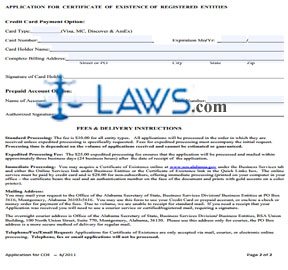

Form AL Application for Certificate of Existence

INSTRUCTIONS: AL APPLICATION FOR CERTIFICATE OF EXISTENCE

This form is not used for a Certificate of Good Standing. This form is used for a business or non-profit entity indexed or registered under the Office of the Alabama Secretary of State. A separate form is required for each Entity Identification Number.

“AL Application for Certificate of Existence Step 1”

In part 1 of the form, list your Alabama Entity ID Number in this form (000-000). In order to find the Entity Identification Number, you can reference www.sos.alabama.gov and click under the Government Records Tab.

Then, reference the Business Entity Records. Choose “Entity Name” and type the registered name in the indicated box. The Entity Identification Number will appear on the left-hand side of the entity name.

“AL Application for Certificate of Existence Step 2”

The state of Alabama strongly encourages you to click on the Entity Identification Number to the left and regard the details to make sure you’ve referenced the right entity. The state also recommends printing these details because you’ll need this information while making a request with the Secretary of State’s Office and for filing Business Privilege Tax Returns as well.

“AL Application for Certificate of Existence Step 3”

In part 2, select the type of payment. Expedited processing is recommended. In part 3, state the person’s name to which the certificate of existence needs forwarded. Provide their mailing address on the line provided below.

“AL Application for Certificate of Existence Step 4”

If you’re paying by credit card, fill out the first section on the second page of the form. Provide the card type, card number, expiration date, card hold name, and billing address. If you have a prepaid account, fill out the second section on the second page of the form. Provide the name on the account, the account number, and an authorized signature.

“AL Application for Certificate of Existence Step 5”

You can submit this form electronically for faster processing. If you’re mailing the form, send it to the Office of the Alabama Secretary of State, Business Services Divisions/Business Entities at PO Box 5616, Montgomery, AL, 36130. Ask the mail service for a delivery receipt. If you choose the expedited processing option, the application is processed and mailed, at most, three business days after the form is received.