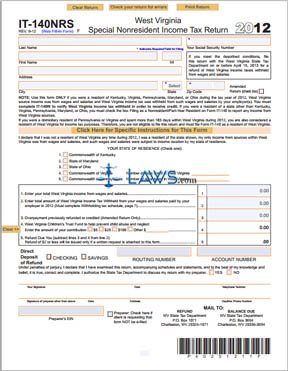

Form IT-140 NRS Special Non-Resident Income Tax Return

INSTRUCTIONS: WEST VIRGINIA SPECIAL NONRESIDENT INCOME TAX RETURN (Form IT-140NRS)

Kentucky, Virginia, Pennsylvania, Maryland and Ohio residents who had West Virginia state income tax withheld from their earnings apply for credit for these taxes withheld using a form IT-140NRS. The document can be obtained from the website of the West Virginia State Tax Department.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 1: At the top left-hand corner of the form, enter your last and first name, middle initial, street address, city, state and zip code.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 2: At the top right-hand corner of the form, enter your Social Security number.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 3: If you are filing an amended return, indicate this with a check mark where directed.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 4: In the next section, indicate with a check mark which of the listed states you are a resident of. Those from Pennsylvania and Virginia must also enter how many days they spent in West Virginia.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 5: On line 1, enter your total West Virginia income.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 6: On line 2, enter the total withheld from earnings in West Virginia tax. You must document every employer in section IT-140W, which contains a withholding tax schedule. Give each employer's identification number, name and address, your name, Social Security number and income subject to withholding, and the amount of tax withheld.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 7: Line 3 is only for those filing an amended return to document a previously refunded or credited overpayment.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 8: If you wish to make a contribution to the West Virginia Children's Trust Fund, do so on line 4.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 9: Subtract the sum of lines 3 and 4 from line 2. Enter the resulting difference on line 5. This is the refund you are owed, if applicable.

West Virginia Special Nonresident Income Tax Return IT-140NRS Step 10: If you anticipate receiving a refund, provide your routing and savings number if you wish to receive it as a direct deposit. Indicate with a check mark if this is a checking or savings account.