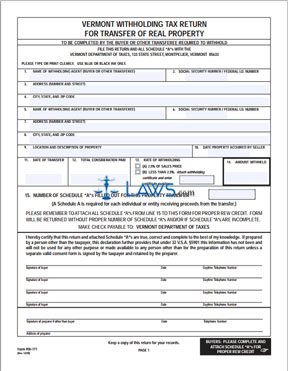

Form RW-171 Withholding Tax Return for Transfer of Real Property

INSTRUCTIONS: VERMONT WITHHOLDING RETURN FOR TRANSFER OF REAL PROPERTY (Form RW-171)

In all Vermont property purchases acquired from a non-resident of the state by two or more individuals, 2.5% of the price must be withheld and a form RW-171 must be filed within 30 days of the transaction. This form can be found on the website of the Vermont Department of Taxes.

Vermont Withholding Return For Transfer Of Real Property RW-171 Step 1: The first page of this form is the return form. Lines one through four request the name of the buyer, their Social Security number or federal identification number, and full address. The same information should be provided for the seller in lines five through eight.

Vermont Withholding Return For Transfer Of Real Property RW-171 Step 2: On line nine, give the location of the property and a brief description. On line 10, give the date the seller acquired the property. On line 11, give the date on which the title was transferred.

Vermont Withholding Return For Transfer Of Real Property RW-171 Step 3: On line 12, give the total price of the transaction. On line 13, indicate with a check mark whether 2.5% of the sale price was withheld or whether the Commissioner of Taxes has authorized a lesser withholding rate. If so, give the certificate number of this authorization and attach a copy. On line 14, give the amount withheld.

Vermont Withholding Return For Transfer Of Real Property RW-171 Step 4: Each individual or entity which receives proceeds part of the proceeds must have a Schedule A filed on their behalf. On line 15, write how many Schedule A forms are being filed. All buyers should sign and date the first page and provide their daytime telephone number. Any paid preparer should do the same.

Vermont Withholding Return For Transfer Of Real Property RW-171 Step 5: The second page is the Schedule A form. In section one, indicate whether the seller is an individual, C-corporation or composite business entity.

Vermont Withholding Return For Transfer Of Real Property RW-171 Step 6: In sections two through eight, give all identifying information required about the seller. In sections eight through 12, describe the property and all aspects of the transaction as instructed. Only complete sections 13 and 14 if the subject of this Schedule A is a shareholder, partner or member of an S-corporation or LLC.