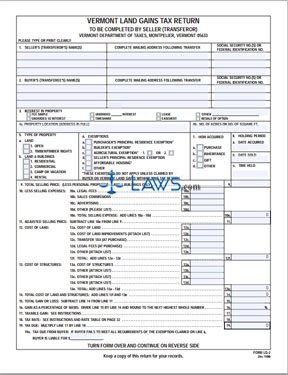

Form LG-1 Land Gains Withholding Tax Return

INSTRUCTIONS: VERMONT LAND GAINS WITHHOLDING TAX RETURN (Form LG-1)

Anyone who buys land in Vermont from someone who has owned it for fewer than six years must file a form LG-1. Unless certain exceptions noted in the form's instructions apply, the buyer is also required to withhold 10% of the purchase price from the seller and pay it to the Department of Taxes. The seller must also file a form LG-2 documenting their purchase. Both documents are available on the website of the Vermont Department of Taxes.

Vermont Land Gains Withholding Tax Return LG-1 Step 1: In section one, give the names, addresses and Social Security or federal identification numbers of all sellers. In section two, give the same information for all purchasers.

Vermont Land Gains Withholding Tax Return LG-1 Step 2: In section three, give the location of the property.

Vermont Land Gains Withholding Tax Return LG-1 Step 3: In section four, give the date on which you acquired the property. In section five, give the date on which the title to the property was transferred.

Vermont Land Gains Withholding Tax Return LG-1 Step 4: In section six, give the total sale price of the property, including all buildings on it. In section seven, give the value of the land which is solely associated with the actual land.

Vermont Land Gains Withholding Tax Return LG-1 Step 5: In section eight, check the box next to any exemptions you are claiming.

Vermont Land Gains Withholding Tax Return LG-1 Step 6: Section nine concerns the sales price attributable solely to the land. If all of the purchase is subject to tax, transfer the number from section seven to section 9d. If all of the purchase is tax exempt, enter zero on section 9d. If only part of the land is exemption from tax, perform all computations as instructed in section nine.

Vermont Land Gains Withholding Tax Return LG-1 Step 7: Section ten only applies to those who have arranged for an installation payment plan. If so, provide all information requested and attach the relevant promissory note.

Vermont Land Gains Withholding Tax Return LG-1 Step 8: In section eleven, follow the instructions to determine how much tax must be paid on the purchase.

Vermont Land Gains Withholding Tax Return LG-1 Step 9: All purchasers must sign and date the form. Any preparer must include their name, address and telephone number.