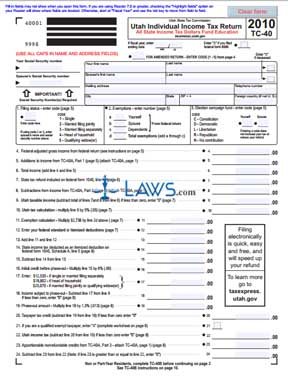

Form TC-40 Utah Individual Income Tax Return

INSTRUCTIONS: UTAH INDIVIDUAL INCOME TAX RETURN (Form TC-40)

Individuals owing Utah income tax may file it using a form TC-40. This document can be obtained from the website of the Utah State Tax Commission.

Utah Individual Income Tax Return TC-40 Step 1: If filing on a fiscal year basis, enter its ending month and year.

Utah Individual Income Tax Return TC-40 Step 2: Enter your Social Security number and name, as well as the same information for your spouse if filing a joint return.

Utah Individual Income Tax Return TC-40 Step 3: Enter your full address and telephone number.

Utah Individual Income Tax Return TC-40 Step 4: In box 1, indicate your filing status by filling in the appropriate numeral.

Utah Individual Income Tax Return TC-40 Step 5: In box 2, note all exemptions you are claiming.

Utah Individual Income Tax Return TC-40 Step 6: If you wish to donate to an election campaign fund, note this in box 3.

Utah Individual Income Tax Return TC-40 Step 7: On line 4, enter your federal adjusted gross income.

Utah Individual Income Tax Return TC-40 Step 8: On line 5, enter your additions to income as calculated on form TC-40A.

Utah Individual Income Tax Return TC-40 Step 9: On line 6, enter the sum of lines 4 and 5.

Utah Individual Income Tax Return TC-40 Step 10: On line 7, enter your state tax refund as documented on your federal 1040 return.

Utah Individual Income Tax Return TC-40 Step 11: On line 8, enter your subtractions to income as documented on form TC-40A.

Utah Individual Income Tax Return TC-40 Step 12: Add lines 7 and 8. Subtract this sum from line 6. Enter the resulting difference on line 9.

Utah Individual Income Tax Return TC-40 Step 13: Multiply line 9 by .05. Enter the resulting product on line 10. This is your Utah tax.

Utah Individual Income Tax Return TC-40 Step 14: Complete lines 10 through 44 as instructed to calculate your adjusted tax liability or refund owed.

Utah Individual Income Tax Return TC-40 Step 15: If you wish to receive a refund via direct deposit, enter all requested account information on line 45.

Utah Individual Income Tax Return TC-40 Step 16: Sign and date the form. If filing jointly, your spouse must do the same.