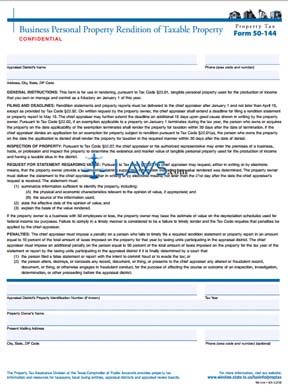

Form 50-144 Business Personal Property Rendition of Taxable Property

INSTRUCTIONS: TEXAS BUSINESS PERSONAL PROPERTY RENDITION OF TAXABLE PROPERTY (Form 50-144)

If you are the Texas proprietor of a business, you must file a form detailing all "personal property," defined as every kind of asset used in your business that is not real estate. This form 10-144 is available on the website of the Texas comptroller.

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 1: On the first page, enter the name of your appraisal district, your phone number, and your complete address, including your zip code.

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 2: On the bottom of the first page, enter your appraisal district's property identification number if known. Also provide the tax year, the name of the property owner, and their current mailing address. You may enter a telephone number, but this is optional

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 3: If you are an authorized agent or fiduciary, indicate this at the top of the second page. Give your name and address, as well as your phone number if you wish to.

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 4: Indicate with a check mark whether the property in question is under $20,000 or $20,000 or more. If under $20,000, you need only complete Schedule A. Otherwise, you will need to complete Schedules B or C as applicable.

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 5: Indicate whether you are the property owner or another person. Sign and date the second page in the presence of a notary public.

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 6: Schedule A concerns personal property valued in total at less than $20,000. Describe each piece of property and the address where it is located. You may enter a good faith estimate of its current market value, but this is optional. If you are not the owner, enter their name and address.

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 7: Schedule B concerns all personal property worth $20,000 or more. Describe all property and provide all other information requested.

Texas Business Personal Property Rendition Of Taxable Property 50-144 Step 8: Schedule C concerns inventory assets.