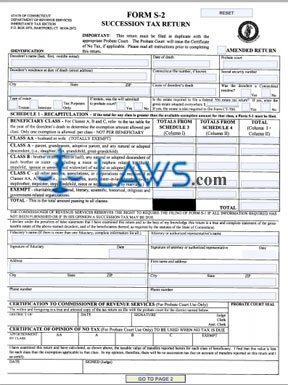

Form S-2 Succession Tax Return

INSTRUCTIONS: CONNECTICUT SUCCESSION TAX RETURN (Form S-2)

In Connecticut, a succession tax return is filed when it appears no tax must be paid to the state following the death of a decedent because the gross value of the property being passed on is less than the exemption for the class of the person inheriting. This document is found on the website of the government of Connecticut.

Connecticut Succession Tax Return S-2 Step 1: Enter the decedent's name, date of death, residence address on the date of death, cause of death, state file number assigned to the case if known, the probate court hearing the case if applicable and the Social Security number of the decedent.

Connecticut Succession Tax Return S-2 Step 2: Indicate with check marks the decedent was a resident of the state, the type of estate, whether the will was admitted to probate court if one was left, and if the estate was required to file a federal form 706. If yes, enter the gross value of the estate in all locations.

Connecticut Succession Tax Return S-2 Step 3: Complete Schedules 3 and 4 on the second page first. Schedule 3 concerns solely owned property passed on through a will or by the laws of intestacy. Give a description of the property in the first column, the name of the beneficiary in the second column, the beneficiary's relationship to the decedent in the third column, and the property's fair market value in the fourth column.

Connecticut Succession Tax Return S-2 Step 4: In Schedule 4, provide the same information regarding jointly owned survivorship property and property passed on by means other than a will or the laws of intestacy.

Connecticut Succession Tax Return S-2 Step 5: Return to the first page. Five classes of beneficiaries are listed. Class AA on the first line concerns husbands and wives, Class A on the second line concerns parents, grandparents, adoptive parents and children, Class B concerns brothers, sisters and relatives of brothers and sisters such as nieces and nephews, Class C concerns all other inheritors not listed above, and the last class is exempt charitable organizations. Detail the total of each type of property inherited by all such classes in the appropriate columns.

Connecticut Succession Tax Return S-2 Step 6: The fiduciary and authorized estate representative should provide all identifying information requested and complete the questionnaire in Schedule 2.