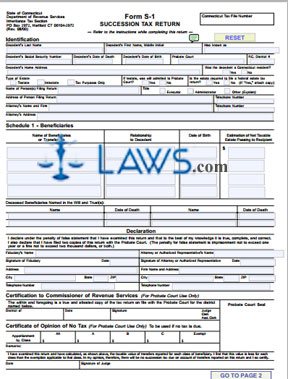

Form S-1 Succession Tax Return

INSTRUCTIONS: CONNECTICUT SUCCESSION TAX RETURN (Form S-1)

In Connecticut, a form S-1 should be filed when a resident or non-resident dies in the state and the value of their estate will probably exceed the value of the credit that can be claimed by beneficiaries. The form is found on the website of the government of Connecticut.

Connecticut Succession Tax Return S-1 Step 1: In the first section, "Identification," provide all information requested about the decedent, the estate, the person filing the return, and the attorney handling the estate.

Connecticut Succession Tax Return S-1 Step 2: In schedule 1, give the name of all living beneficiaries, their relationship to the decedent, their date of birth, and an estimation of the value of the net taxable estate passing on to them. Also give the names and dates of death of any deceased beneficiaries named in a will.

Connecticut Succession Tax Return S-1 Step 3: Answer all general questions in schedule 2.

Connecticut Succession Tax Return S-1 Step 4: Skip to schedule 4 and document all real property not owned in survivorship. Transfer this to line 1. Document stocks and bonds not owned in survivorship in schedules 5A and 5B. Enter their total on line 2. Document miscellaneous personal property not owned in survivorship in schedule 6. Transfer this value to line 3.

Connecticut Succession Tax Return S-1 Step 5: Survivorship bank accounts and U.S. savings bonds are documented in schedules 7A, 7B and 7E and entered on lines 4 and 5. The total of lines 4 and 5 is entered on line 6. Document survivorship property which has been conceded as entirely taxable in schedule 8A and transfer it to line 7 Fractionally taxable survivorship property is documented on schedules 8B and 8C and entered on line 8. Total lines 7 and 9 on line 9.

Connecticut Succession Tax Return S-1 Step 6: Power of appointment are documented on schedule 9 and transferred to line 10. Transfers during the decedent's lifetime are document on schedule 10 and entered on line 11. Death benefits, annuities, pensions and retirement benefits are documented on schedule 11 and entered on line 12. Add lines 1 through 12 and enter them on line 13.

Connecticut Succession Tax Return S-1 Step 7: Document deductions on schedule 12 and transfer them to lines 14 through 25. Complete all remaining tax calculations as instructed.