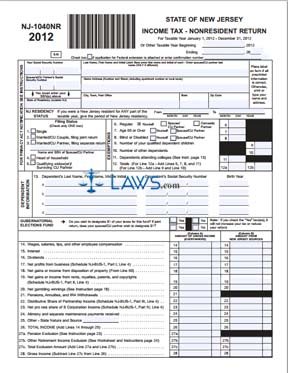

Form NJ-1040NR Income Tax Nonresident Return

INSTRUCTIONS: NEW JERSEY INCOME TAX - NONRESIDENT RETURN (Form NJ-1040NR)

Nonresidents who derived income from New Jersey file their state income tax using a form NJ-1040NR. This document is found on the website of the state of New Jersey.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 1: Those who are not filing on a a calendar year basis should enter the beginning and ending dates of their fiscal year at the top right of the first page.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 2: Enter your name and Social Security number. Include the same information for your spouse if filing jointly.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 3: Enter your address. Separately, enter the state in which you live.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 4: Give the starting and ending dates of your New Jersey residency, if applicable.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 5: Indicate your filing status by checking the box next to the applicable statement on lines one through five.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 6: Check off all exemptions applicable to you or your spouse on lines six through 11. Total them on line 12.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 7: Give the names, Social Security numbers and birth years of all dependents in box 13.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 8: If you or your spouse wish to donate a dollar to the gubernatorial elections fund, indicate so with a check mark.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 9: On lines 14 through 28, follow the instructions to document and calculate your gross income. Enter numbers relating to your gross income from all sources and states in column A, and numbers related only to New Jersey earnings in column B. Note that to complete line 14 you will need to complete Part III on the third page and to complete lines 18 and 19, you will first need to complete Parts I and II

on the same page.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 10: Complete lines 29 through 55 as instructed to determine your tax or refund owed.

New Jersey Income Tax - Nonresident Return NJ-1040NR Step 11: Sign and date the bottom of the second page.