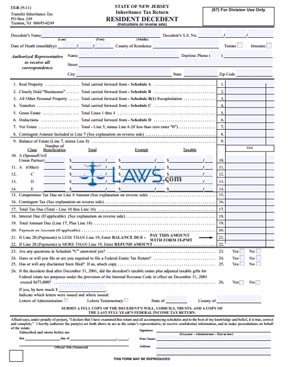

Form IT-R Inheritance Tax Return Resident

INSTRUCTIONS: NEW JERSEY INHERITANCE TAX RETURN RESIDENT DECEDENT (Form IT-R)

When a resident of New Jersey dies, the inheritance tax owed to the state is filed using a form IT-R. This document is found on the website of the state of New Jersey as part of a larger booklet containing instructions and all potentially necessary supplemental documents. This article discusses the form IT-R itself.

New Jersey Inheritance Tax Return Decedent IT-R Step 1: Enter the decedent's name, Social Security number, date of death and county of residence. Indicate with a check mark whether they died in a testate or intestate condition.

New Jersey Inheritance Tax Return Decedent IT-R Step 2: Give the name, daytime phone number, and complete mailing address of a representative authorized to receive all related correspondence.

New Jersey Inheritance Tax Return Decedent IT-R Step 3: Document all real property in the estate on Schedule A, included in the packet. Transfer the total from there to line 1 of the IT-R.

New Jersey Inheritance Tax Return Decedent IT-R Step 4: Complete Schedule B to determine the total value of all closely held "businesses." Transfer the total from there to line 2 of the IT-R.

New Jersey Inheritance Tax Return Decedent IT-R Step 5: Complete Schedule B(1) to determine the total value of all other personal property. Transfer the total from there to line 3 of the IT-R.

New Jersey Inheritance Tax Return Decedent IT-R Step 6: Complete Schedule C to determine the total value of all transfers. Transfer the total from there to line 4 of the IT-R.

New Jersey Inheritance Tax Return Decedent IT-R Step 7: Add lines 1 through 4 to determine the gross estate value. Enter this sum on line 5.

New Jersey Inheritance Tax Return Decedent IT-R Step 8: Complete Schedule D to determine the sum of all applicable deductions. Enter this value on line 6.

New Jersey Inheritance Tax Return Decedent IT-R Step 9: Subtract line 6 from line 5 and enter the difference on line 7 to determine the net estate value. If applicable, enter the contingent amount included on line 7 separately on line 8.

New Jersey Inheritance Tax Return Decedent IT-R Step 10: Complete lines 9 through 22 as instructed to determine tax owed or refund due from the state. Answer lines 23 through 26 by checking "Yes" or "No." Sign and date the form before a notary.