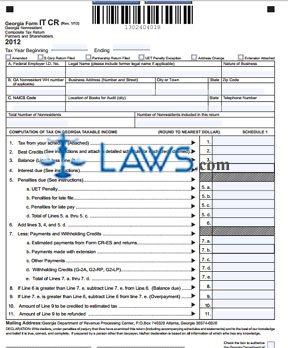

Form IT-CR Georgia Non-Resident Composite Tax Return

INSTRUCTIONS: GEORGIA NONRESIDENT COMPOSITE TAX RETURN PARTNERS AND SHAREHOLDERS (Form IT CR)

A form IT CR is used instead of withholding taxes from nonresident partners, shareholders or members in Georgia partnerships, LLCs and S Corporations. The form IT CR is filed by the business and found on the website of the Georgia Department of Revenue.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 1: Enter the beginning and ending dates of the fiscal year if not filing on a calendar year basis.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 2: Give your federal employer identification number, legal name and the nature of your business on line A.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 3: On line B, give your GA nonresident WH number (if applicable) and business address.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 4: On line C, give your NAICS code and location of your books to be reviewed in case of an audit, and enter the total number of nonresidents and the number included on this return.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 5: Consult the schedule on page three to determine your tax owed and enter it on line 1.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 6: Enter the total number of best credits claimed on line 2 and attach a detailed schedule for each one claimed.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 7: Subtract line 2 from line 1 and enter the difference on line 3.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 8: If you are filing or paying late, compute interest owed on line 4 and penalties due on line 5.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 9: Add lines 3, 4 and 5d and enter the sum on line 6.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 10: Document payments already made and credits on lines 7a through 7d. Enter the total of these lines on line 7e.

Georgia Nonresident Composite Tax Return Partners And Shareholders IT CR Step 11: Complete lines 8 through 11 as instructed to determine what balance is owed or what refund you are entitled to receive.