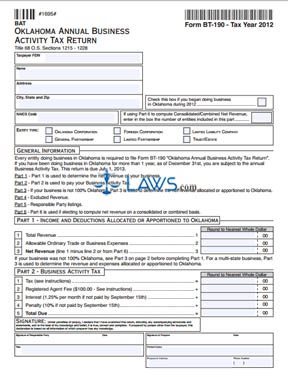

Form BT-190 Oklahoma Annual Business Activity Tax Return

INSTRUCTIONS: OKLAHOMA ANNUAL BUSINESS ACTIVITY TAX RETURN (Form BT-190)

Any corporation, limited liability company or partnership or business trust doing business in the state of Oklahoma must complete and file a form BT-190. This is also the case for any entity doing business in the state for a year or longer. The document can be obtained from the website of the Oklahoma Tax Commission.

Oklahoma Annual Business Activity Tax Return BT-190 Step 1: At the top of the form, enter your federal employer identification number, business name and address. If you began doing business in the state in the year for which you are filing, check the box where indicated.

Oklahoma Annual Business Activity Tax Return BT-190 Step 2: Enter your NAICS code. If you will be filing on a consolidated or combined net revenue basis, write the number of entities for which you will be filing.

Oklahoma Annual Business Activity Tax Return BT-190 Step 3: Check the box next to the type of entity for which you are filing.

Oklahoma Annual Business Activity Tax Return BT-190 Step 4: Part 1 requires you to document your revenue. Corporations which operate in multiple states should first complete Part 3 on the second page before completing this section. Corporations which are only based in Oklahoma should skip Part 3.

Oklahoma Annual Business Activity Tax Return BT-190 Step 5: Part 2 requires you to calculate your tax owed, including any penalty and interest if filing late.

Oklahoma Annual Business Activity Tax Return BT-190 Step 6: Enter the name of the taxpayer and the federal identification number at the top of pages 2, 3 and 4.

Oklahoma Annual Business Activity Tax Return BT-190 Step 7: Part 4 requires you to document income excluded from Part 1, including interest, dividends and deductions, real estate rentals, mineral rights, net capital gains and compensation.

Oklahoma Annual Business Activity Tax Return BT-190 Step 8: Parts 5 and 6 are only for those filing on a consolidated or combined basis. If so, provide the name, Social Security number, home address, title and daytime phone number for the responsible party for each entity in part 5. Compute the consolidated or combined net revenue in part 6 as instructed.

Oklahoma Annual Business Activity Tax Return BT-190 Step 9: A responsible party should sign and date the first page and provide their title.