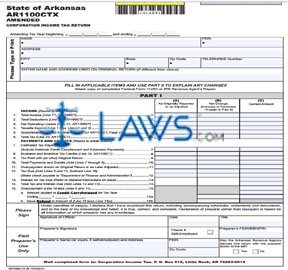

Form AR1100CTX Amended Corporation Income Tax Return

INSTRUCTIONS: ARKANSAS AMENDED CORPORATION INCOME TAX RETURN (Form 1100CTX)

A form 1100CTX is used by corporations operating in Arkansas to amend tax returns filed for tax years 2009 and before. For tax years beginning on or after 2010, file a form 1100CT instead and mark it as amended. The form 1100CTX must be filed within 3 years of the initial due date or within 3 years of the originally filed return, except in cases of an IRS audit. The document is found on the website of the Arkansas Department of Finance and Administration.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 1: Give the beginning and ending dates of the tax year being amended.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 2: Give your corporation's name, address, federal employer identification number and telephone number. If your name and address was different on your originally filed return, enter that where indicated.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 3: Three columns must be filled in for every line you complete. Column A is for your originally reported or last adjusted figures, Column B is for the net increase or decrease between the original and corrected figures, and Column C is for the corrected figures. Enter your total income on line 1.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 4: Calculate your tax liability as instructed on lines 2 through 6.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 5: Lines 7 through 15 apply payments already made and credits to adjust your tax liability.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 6: On Part II on the second page, you must provide a detailed written explanation of all changes made. Include the line number for every change and attach all applicable supporting schedules.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 7: An officer of the corporation should sign and date the bottom of the first page and provide their title.

Arkansas Amended Corporation Income Tax Return 1100CTX Step 8: If a paid preparer has completed the document, they should sign and print their name, give their address, indicate if they are self-employed and enter their identification number. Indicate with a check mark if the preparer is authorized to discuss the return with the Arkansas Revenue Agency. Mail the completed return to the address at the bottom of the first page.