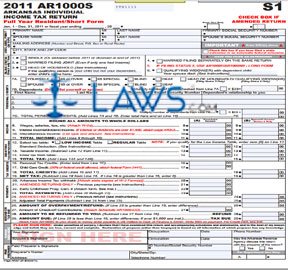

Form AR1000S Individual Income Tax Return Resident Short Form

INSTRUCTIONS: ARKANSAS INDIVIDUAL INCOME TAX RETURN (Form AR1000S)

Arkansas full-year residents whose income is only derived from wages, salaries, tips, interest, dividends and miscellaneous income, who do not itemize their deductions, and whose only claimed credits are personal, child and dependent care or early childhood program credits can use the short-form AR1000S return to file their state taxes. The document is found on the website of the Arkansas Department of Finance and Administration.

Arkansas Individual Income Tax Return AR1000S Step 1: Enter your name and Social Security number, as well as that of your spouse if filing jointly.

Arkansas Individual Income Tax Return AR1000S Step 2: Enter your mailing address.

Arkansas Individual Income Tax Return AR1000S Step 3: Indicate your filing status with a check mark.

Arkansas Individual Income Tax Return AR1000S Step 4: Check the box next to all personal credits being claimed. If you have any dependents, give their name, Social Security number and relationship to you.

Arkansas Individual Income Tax Return AR1000S Step 5: All amounts entered should be entered to the nearest whole dollar. If you are married but filing separately, your spouse's income will go in Column B. Otherwise, enter your single or joint income in Column A. Document your income on lines 8 through 10 and enter the total of these lines on line 11.

Arkansas Individual Income Tax Return AR1000S Step 6: Lines 12 through 15 provide instructions for calculating your total tax due.

Arkansas Individual Income Tax Return AR1000S Step 7: Lines 16 through 19 apply credits to calculate your net tax due.

Arkansas Individual Income Tax Return AR1000S Step 8: Lines 20 through 25 adjust your tax liability based on tax payments withheld from your wages. Lines 21 and 24 are only for those filing an amended return.

Arkansas Individual Income Tax Return AR1000S Step 9: Lines 26 through 29 provide instructions for the final calculations necessary to determine your tax due or refund owed.

Arkansas Individual Income Tax Return AR1000S Step 10: Sign the bottom of the form, and enter your occupation, the date and your phone number. If filing with your spouse, they should do the same.

Arkansas Individual Income Tax Return AR1000S Step 11: If a paid preparer has completed this form, they should sign and print their name, give their address and ID number and provide a telephone number.