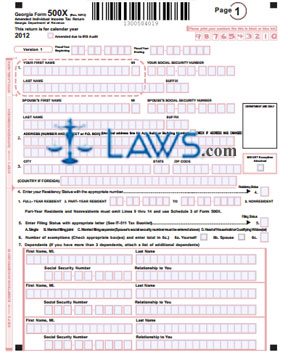

Form 500X Amended Individual Income Tax

INSTRUCTIONS: GEORGIA AMENDED INDIVIDUAL INCOME TAX RETURN (Form 500X)

Georgia residents amend an initially filed state income tax return using a form 500X. This document is found on the website of the Georgia Department of Revenue.

Georgia Amended Individual Income Tax Return 500X Step 1: On page 1, provide your name, that of your spouse if filing jointly, and your address on lines 1 through 3.

Georgia Amended Individual Income Tax Return 500X Step 2: Line 4 concerns your residency status, line 5 concerns your filing status, line 6 concerns the number of exemptions, and line 7 requires you to detail your dependents.

Georgia Amended Individual Income Tax Return 500X Step 3: Lines 8 through 10 concern your income.

Georgia Amended Individual Income Tax Return 500X Step 4: Lines 11 through 13 concern deductions.

Georgia Amended Individual Income Tax Return 500X Step 5: Lines 14a through 20 provide instructions for the computation of tax. Note that to complete line 17, you will need to first complete schedule 2, which is on the fifth page. Tax computation instructions continue on the next page on lines 22 through 33.

Georgia Amended Individual Income Tax Return 500X Step 6: If you expect to receive a refund and wish to have it directly deposited into a checking or savings account, provide your routing or account number on line 33a.

Georgia Amended Individual Income Tax Return 500X Step 7: You must attach a sheet providing a full explanation of all changes being reported.

Georgia Amended Individual Income Tax Return 500X Step 8: Schedule 1 on the next page concerns adjustments to income.

Georgia Amended Individual Income Tax Return 500X Step 9: Schedule 3 is solely for the use of part-year residents and nonresidents. If this applies to you, do not complete lines 14 through 22 from the first part of the form.

Georgia Amended Individual Income Tax Return 500X Step 10: Sign and date the third page. Provide your phone number and the date. If filing jointly with your spouse, they must sign as well.

Georgia Amended Individual Income Tax Return 500X Step 11: Any preparer should give their identification numbers and phone number. If you wish to authorize them to discuss your tax return with the Department of Revenue, indicate this with a check mark.