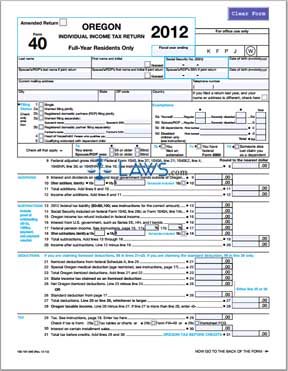

Form 40 Individual Income Tax Return Resident

INSTRUCTIONS: OREGON INDIVIDUAL INCOME TAX RETURN (Form 40)

Full-time Oregon residents file their state income tax using a form 40. This document is found on the website of the state of Oregon.

Oregon Individual Income Tax Return 40 Step 1: If you file on a fiscal year basis, give its end date.

Oregon Individual Income Tax Return 40 Step 2: Enter your full name, Social Security number and date of birth. Those filing jointly with a spouse should provide this information for them as well.

Oregon Individual Income Tax Return 40 Step 3: Enter your complete address and telephone number.

Oregon Individual Income Tax Return 40 Step 4: Indicate your filing status with a check mark. Choose the option listed on lines 1 through 5 which applies.

Oregon Individual Income Tax Return 40 Step 5: Note all exemptions on lines 6a through 6d. Enter the total claimed on line 6e.

Oregon Individual Income Tax Return 40 Step 6: Check the box next to all statements which apply on line 7.

Oregon Individual Income Tax Return 40 Step 7: Enter your federal adjusted gross income on line 8 as calculated on your federal form 1040, 1040EZ, 1040A, 1040NR or 1040NR-EZ.

Oregon Individual Income Tax Return 40 Step 8: Calculate additions to your income as instructed on lines 9 through 12.

Oregon Individual Income Tax Return 40 Step 9: Lines 13 through 20 concern subtractions. Include all documents substantiating your claims of income already withheld, such as copies of W2 forms.

Oregon Individual Income Tax Return 40 Step 10: If claiming itemized deductions, complete lines 21 through 25. If claiming a standard deduction, only complete line 26. Regardless, complete lines 27 and 28.

Oregon Individual Income Tax Return 40 Step 11: Lines 29 through 32 compute your total tax owed prior to the application of credits.

Oregon Individual Income Tax Return 40 Step 12: Lines 33 through 41 adjust your tax after the application of nonrefundable credits.

Oregon Individual Income Tax Return 40 Step 13: Lines 42 through 72 provide instructions for final income and tax owed adjustments.

Oregon Individual Income Tax Return 40 Step 14: If you are owed a refund and wish to receive it as a direct deposit, enter your bank account number and routing number on line 73.

Oregon Individual Income Tax Return 40 Step 15: Sign and date the bottom of the second page.

Full-time Oregon residents file their state income tax using a form 40. This document is found on the website of the state of Oregon.

Oregon Individual Income Tax Return 40 Step 1: If you file on a fiscal year basis, give its end date.

Oregon Individual Income Tax Return 40 Step 2: Enter your full name, Social Security number and date of birth. Those filing jointly with a spouse should provide this information for them as well.

Oregon Individual Income Tax Return 40 Step 3: Enter your complete address and telephone number.

Oregon Individual Income Tax Return 40 Step 4: Indicate your filing status with a check mark. Choose the option listed on lines 1 through 5 which applies.

Oregon Individual Income Tax Return 40 Step 5: Note all exemptions on lines 6a through 6d. Enter the total claimed on line 6e.

Oregon Individual Income Tax Return 40 Step 6: Check the box next to all statements which apply on line 7.

Oregon Individual Income Tax Return 40 Step 7: Enter your federal adjusted gross income on line 8 as calculated on your federal form 1040, 1040EZ, 1040A, 1040NR or 1040NR-EZ.

Oregon Individual Income Tax Return 40 Step 8: Calculate additions to your income as instructed on lines 9 through 12.

Oregon Individual Income Tax Return 40 Step 9: Lines 13 through 20 concern subtractions. Include all documents substantiating your claims of income already withheld, such as copies of W2 forms.

Oregon Individual Income Tax Return 40 Step 10: If claiming itemized deductions, complete lines 21 through 25. If claiming a standard deduction, only complete line 26. Regardless, complete lines 27 and 28.

Oregon Individual Income Tax Return 40 Step 11: Lines 29 through 32 compute your total tax owed prior to the application of credits.

Oregon Individual Income Tax Return 40 Step 12: Lines 33 through 41 adjust your tax after the application of nonrefundable credits.

Oregon Individual Income Tax Return 40 Step 13: Lines 42 through 72 provide instructions for final income and tax owed adjustments.

Oregon Individual Income Tax Return 40 Step 14: If you are owed a refund and wish to receive it as a direct deposit, enter your bank account number and routing number on line 73.

Oregon Individual Income Tax Return 40 Step 15: Sign and date the bottom of the second page.