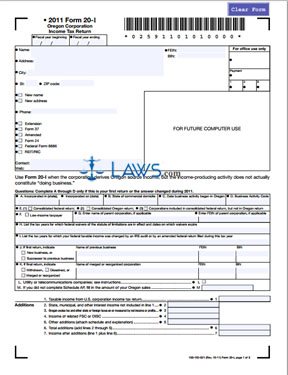

Form 20-I Oregon Corporation Income Tax Return

INSTRUCTIONS: OREGON CORPORATION INCOME TAX RETURN (Form 20-I)

Corporations which derive Oregon income without technically "doing business" in the state file their state income tax return owed with a form 20-I. This document can be obtained from the website of the state of Oregon.

Oregon Corporation Income Tax Return 20-I Step 1: The top of the form requires you to give your business name, address and tax identification numbers.

Oregon Corporation Income Tax Return 20-I Step 2: If filing under a new name or from a new address, indicate this with a check mark.

Oregon Corporation Income Tax Return 20-I Step 3: Enter your phone number.

Oregon Corporation Income Tax Return 20-I Step 4: Indicate with a check mark the type of return being filed.

Oregon Corporation Income Tax Return 20-I Step 5: Questions A through D should only be completed by corporations filing with the state for the first time or those whose answers to these questions have changed during the previous year.

Oregon Corporation Income Tax Return 20-I Step 6: On line E, indicate whether the business was documented in a consolidated Oregon or federal return, or whether the corporation was included in a consolidated federal return but not in a consolidated Oregon return.

Oregon Corporation Income Tax Return 20-I Step 7: If you are a low-income taxpayer, check box F. If you have a parent corporation, enter its name in box G and, if applicable, its federal employer identification number. Lines H and I concern federal waivers and years in which you were audited or filed an amended federal return.

Oregon Corporation Income Tax Return 20-I Step 8: Line J is for those filing a first time return. Line K is for those filing a final return. Line L is for utility and telephone companies. Line M is for those corporations which did not complete a Schedule AP.

Oregon Corporation Income Tax Return 20-I Step 9: Enter your total taxable income on line 1.

Oregon Corporation Income Tax Return 20-I Step 10: Lines 2 through 7 compute your income after additions.

Oregon Corporation Income Tax Return 20-I Step 11: Lines 8 through 34 compute your subtractions, tax owed and refund, if any. Document estimated tax payments or prepayments made in the box under Schedule ES.

Oregon Corporation Income Tax Return 20-I Step 12: An officer should sign and date the bottom of the second page.