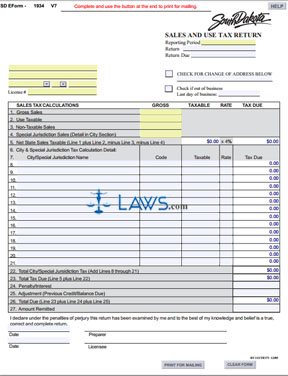

Form E1934V7 Sales Return

INSTRUCTIONS: SOUTH DAKOTA SALES AND USE TAX RETURN (Form Eform 1934-V7)

All South Dakota businesses must file a sales and use tax return even in periods when no tax is due. The form is found on the website of the government of South Dakota.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 1: At the top right-hand corner, enter the reporting period covered, the return number, and date on which it is due.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 2: Check the box where indicated if you are filing a form documenting a change of business address.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 3: Check the box below if you are filing a return for a business which has ceased operation. Enter the last date of business.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 4: On the left, give your address and license number.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 5: On line 1, give your gross sales. On line 2, give your sales which are subject to use tax. On line 3, give your non-taxable sales amount.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 6: Document any special jurisdictional sales on lines 7 through 21. Include the name of the city or jurisdiction, their code, the taxable amount of the transaction, the rate and the tax due for each transaction. Enter the total on line 22 and transfer this to line 4. Subtract line 4 from the total of lines 1 through 3 . Multiply this by 4% to determine the net state sales tax due on line 5.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 7: Add lines 5 and 22 to determine the total of your city and special jurisdictional tax owed on line 23.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 8: Consult the instructions to determine how much penalty and interest is owed if filing late. Enter this amount on line 24. Enter any previous tax paid or credit on line 25.

South Dakota Sales And Use Tax Return Eform 1934-V7 Step 9: Subtract line 25 from the sum of lines 23 and 24 to determine the amount due on line 26. On line 27, write how much payment is being submitted with your return.