Form Annual Reconciliation 2011

INSTRUCTIONS: RHODE ISLAND SALES AND USE TAX RETURN - ANNUAL RECONCILIATION (Form T-204R)

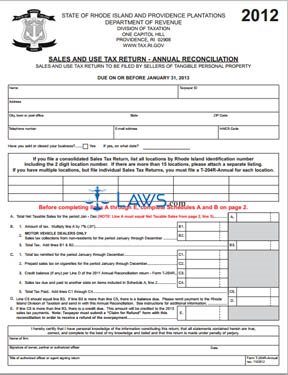

All Rhode Island businesses must annually file a form T-204R with the state's Division of Taxation. This form can be found on that government department's website. The form must be filed on or before January 31 of the year in question.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 1: On the top of the first page, enter your business name, address, taxpayer ID number, email address and the NAICS code which describes your operations.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 2: Complete Schedules A and B on the second page first. On line 1 of Schedule A, enter your gross sales as applicable in the categories listed.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 3: On line 2, enter the cost of personal property purchased from an out-of-state retailer liable for use tax. Provide the total of lines 1 and 2 on line 3.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 4: On line 4 of Schedule B, enter the totals of all exempt sales in the categories detailed on lines 4a through 4n. Provide the total on line 4o.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 5: Subtract the sum on line 4o from line 3. Enter this total on line 5 and transfer it to line A of page 1.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 6: On the first page, indicate with a check mark if you are filing a return concerning a business which you have closed or sold.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 7: If filing a return concerning multiple business locations, enter the Rhode Island identification number of each location.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 8: On line B1, multiply line A by 7% to determine the state tax due. Motor vehicle dealers only should complete line B2 and combine the total on line B3.

Rhode Island Sales And Use Tax Return - Annual Reconciliation T-204R Step 9: Document total taxes prepaid and prepaid sales taxes in section C. If line C3 is greater than line B3, you must pay the difference due.