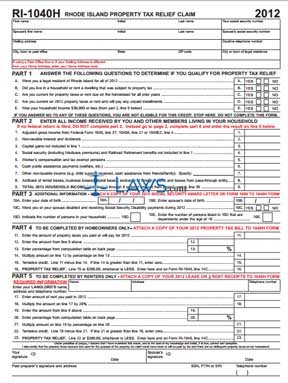

Form 1040H Property Tax Relief Claim

INSTRUCTIONS: RHODE ISLAND PROPERTY TAX RELIEF CLAIM (Form RI-1040H)

Full time Rhode Island residents who are up to date on their property tax payments and whose household income is $30,000 or less can apply for property tax relief by filing a form RI-1040H. This form can be found on the website of the state of Rhode Island's Division of Taxation.

Rhode Island Property Tax Relief Claim RI-1040H Step 1: At the top of the page, enter your full name, address and Social Security number. If you file your taxes jointly, enter your spouse's name and Social Security number as well.

Rhode Island Property Tax Relief Claim RI-1040H Step 2: Questions A through E under "Part I" concern your eligibility. You must be able to answer "yes" to all questions to continue completing the form.

Rhode Island Property Tax Relief Claim RI-1040H Step 3: Part 2 concerns the income generated by all members of your household. Those who did not file a federal tax return will need to first complete the worksheet labeled "Part 6" on the second page in order to determine their adjusted gross income and enter it on line 9. Otherwise, transfer this amount from your IRS form 1040, 1040A or 1040EZ as applicable.

Rhode Island Property Tax Relief Claim RI-1040H Step 4: Those who filed a federal tax return should complete lines 2 through 8 under part 2. Add lines 1 through 8 and enter the result on line 9.

Rhode Island Property Tax Relief Claim RI-1040H Step 5: Part 3 asks for your date of birth, your spouse's date of birth if applicable, to indicate if either you or your spouse received Social Security disability payments in the last year, how many people are in your household, and how many dependants under 18 are in your household.

Rhode Island Property Tax Relief Claim RI-1040H Step 6: Part 4 should only be completed by homeowners. Attach a copy of your property tax bill for the year in question.

Rhode Island Property Tax Relief Claim RI-1040H Step 7: Part 5 should only be completed by renters, who should also include a copy of their lease for the year in question or their rent receipts.

Rhode Island Property Tax Relief Claim RI-1040H Step 8: Sign and date the form. Your spouse, if any, should do the same. Any paid preparer should sign and provide all requested information.