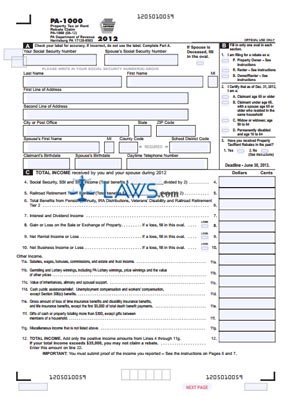

Form PA-1000 Property Tax or Rent Rebate Claim

INSTRUCTIONS: PENNSYLVANIA PROPERTY TAX OR RENT REBATE CLAIM (Form PA-1000)

Pennsylvania residents who are 65 or older, widows and widowers age 50 or older, and disabled persons aged 18 or older may be eligible for a property tax or rent rebate. Read the instructions for form PA-1000 before completing this form. Both the document and the instructions are found on the website of Pennsylvania's Enterprise Portal.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 1: Section A requires that you print your Social Security number, as well as that of your spouse if applicable. If you have been provided with a pre-printed label by the state summarizing your name, address and birthdate, affix this. Otherwise, enter all information requested. If your spouse is dead, fill in the oval where indicated.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 2: In section B, question one, fill in the oval next to "property owner," "renter" or "owner/renter" to indicate what type of relief you are seeking. Question two asks you to fill in the oval next to the statement describing your eligibility. Question three asks you if you have previously received property tax relief or rent rebates.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 3: Section C requires you to detail all income. If your total income exceeds $35,000 on line twelve, you are not eligible for a rebate.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 4: Enter your name and Social Security number at the top of the second page.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 5: Questions thirteen and fourteen should only be completed by property owners.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 6: Questions fifteen through seventeen should only be completed by renters.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 7: Question eighteen should be completed by those who are both renters and owners.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 8: If you wish to receive your rebate via direct deposit, complete questions nineteen through twenty-one. Otherwise, your rebate will be issued via check.

Pennsylvania Property Tax Or Rent Rebate Claim PA-1000 Step 9: On line twenty-two, enter the amount from line two and the maximum rebate from Table A (if an owner) or Table B (if a renter). Both spouses should sign and date the form.