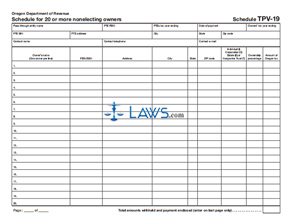

Form OR-19 Pass-Through Entity Withholding

INSTRUCTIONS: OREGON REPORT OF NONRESIDENT OWNER TAX WITHHELD (Form OR-19)

Nonresident owners in a pass-through entity have the taxes withheld from their income derived from income documented on a form OR-19. This document can be obtained from the website of the Oregon Department of Revenue.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 1: Enter the tax year end date of the partnership, S corporation, LLC or LLP or the tax year for which you are filing.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 2: Part A concerns information about the entity. On the first line, enter the name of the partnership, S corporation, LLC or LLP.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 3: On the second line, enter your federal employer identification number.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 4: Enter your street address on the third line.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 5: Enter your city, state and zip code on the fourth line.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 6: Indicate the type of pass-through entity with a check mark.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 7: In Part B, enter the name of the nonresident owner on the first line.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 8: On the second line, enter their Social Security number or Federal Employer Identification Number.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 9: On the third line, enter their street address.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 10: On the fourth line, enter their city, state and zip code.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 11: On the fifth line, indicate whether the owner is an individual or C corporation tax payer by marking an "X" in the appropriate box and enter their tax year end date.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 12: Document the nonresident owner's taxable income and withholding in Part C as instructed.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 13: In the section headed "Taxpayer's Copy," enter the amount of payment made and all other requested information.

Oregon Report Of Nonresident Owner Tax Withheld OR-19 Step 14: Send this form to the nonresident owner.