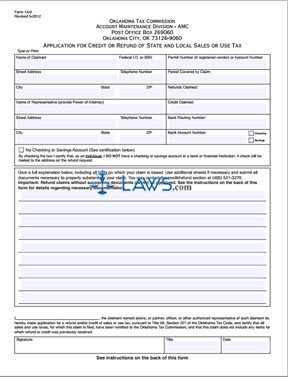

Form 13-9 Application for Refund of State and Local Sales or Use Tax

INSTRUCTIONS: OKLAHOMA APPLICATION FOR CREDIT OR REFUND OF STATE AND LOCAL SALES OR USE TAX (Form 13-9)

Oklahoma residents and vendors may apply for credit or a refund on state and local sales or use tax paid for various reasons, including resale transactions or taxes paid in addition to already paid taxes that were not properly documented. The form is found on the website of the Oklahoma Tax Commission. Complete the form by typing or printing your responses.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 1: Enter the name, address, federal identification or Social Security number and telephone number of the claimant.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 2: If a representative with power of attorney is completing the form, they must provide their name, address and telephone number.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 3: Vendors should provide their permit number, while all others should provide their account number.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 4: Enter the period covered by the claim, the size of the refund and credit sought, and your bank routing and account number.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 5: If you have no checking or savings account, indicate this with a check mark.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 6: In the space provided, give a detailed, written explanation of the grounds on which you are seeking a refund or credit. You must attach all appropriate documentation substantiating your claims as detailed in the instructions on the second page.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 7: Enter your name in the blank provided.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 8: Sign and date the bottom of the page and provide your title.

Oklahoma Application For Credit Or Refund Of State And Local Sales Or Use Tax 13-9 Step 9: The form must be filed within three years of the tax paid for which the claimant is seeking a refund or credit.