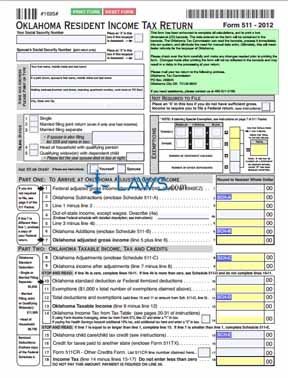

Form 511 Form 2-D Individual Resident Income Tax Return

INSTRUCTIONS: OKLAHOMA RESIDENT INCOME TAX RETURN (Form 511)

Oklahoma residents use a form 511 to file their state income tax returns. This document can be obtained from the website maintained by the Oklahoma Tax Commission.

Oklahoma Resident Income Tax Return 511 Step 1: Enter you and your spouse's Social Security number at the top of the page.

Oklahoma Resident Income Tax Return 511 Step 2: In the table below, enter your name, that of your spouse if filing jointly, and your complete home address.

Oklahoma Resident Income Tax Return 511 Step 3: Indicate your filing status with a check mark in the box where indicated.

Oklahoma Resident Income Tax Return 511 Step 4: Document your exemptions being claimed in the box where indicated.

Oklahoma Resident Income Tax Return 511 Step 5: Enter your federal adjusted gross income on line 1.

Oklahoma Resident Income Tax Return 511 Step 6: Skip to Schedule 511-A on the third page to calculate your subtractions and transfer the result from here to line 2 on the first page.

Oklahoma Resident Income Tax Return 511 Step 7: Complete lines 3 through 5 as directed. Complete Schedule 511-B on the third page to calculate your additions and enter the result on line 6 here.

Oklahoma Resident Income Tax Return 511 Step 8: Add lines 5 and 6 and enter the resulting sum on line 7. This is your Oklahoma adjusted gross income.

Oklahoma Resident Income Tax Return 511 Step 9: Complete lines 8 through 13 as directed to determine your Oklahoma taxable income. Note that to complete line 8, you will first need to complete Schedule 511-C on the third page.

Oklahoma Resident Income Tax Return 511 Step 10: Complete lines 14 through 18 to calculate your tax owed.

Oklahoma Resident Income Tax Return 511 Step 11: Complete lines 19 through 30 as directed to determine your total payments and credits.

Oklahoma Resident Income Tax Return 511 Step 12: Complete lines 31 through 35 to determine your refund owed if applicable. Completing line 33 requires you to first complete schedule 511-G on the fifth page.

Oklahoma Resident Income Tax Return 511 Step 13: Complete lines 36 through 39 to determine the amount you owe.

Oklahoma Resident Income Tax Return 511 Step 14: Sign and date the bottom of the second page where indicated.