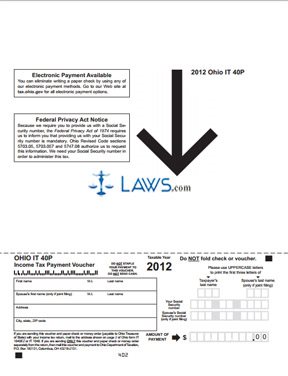

Form IT 40P Income Tax Payment Voucher

INSTRUCTIONS: OHIO INCOME TAX PAYMENT VOUCHER (Form IT 40P)

The state of Ohio encourages residents to file their income tax payments electronically. However, if you choose not to do so, you are required to submit a form IT 40P along with your check or money order. This document can be obtained from the website maintained by the Ohio Department of Taxation.

Ohio Income Tax Payment Voucher IT 40P Step 1: On the first line of the table on the left, enter your first name, middle initial and last name.

Ohio Income Tax Payment Voucher IT 40P Step 2: On the second line, enter your spouse's first name, middle initial and last name. Only provide this information if filing a joint return.

Ohio Income Tax Payment Voucher IT 40P Step 3: On the third line, provide your street address.

Ohio Income Tax Payment Voucher IT 40P Step 4: On the fourth line, enter your city, state and zip code.

Ohio Income Tax Payment Voucher IT 40P Step 5: In the first box on the right, enter the taxpayer's last name in capital letters.

Ohio Income Tax Payment Voucher IT 40P Step 6: In the second box on the right, enter the first three letters of your spouse's last name in capital letters. Only do so if filing jointly.

Ohio Income Tax Payment Voucher IT 40P Step 7: In the third box on the right, enter your Social Security number.

Ohio Income Tax Payment Voucher IT 40P Step 8: In the fourth box on the right, if filing jointly, enter your spouse's Social Security number.

Ohio Income Tax Payment Voucher IT 40P Step 9: In the fifth box on the right, enter the amount of the payment enclosed.

Ohio Income Tax Payment Voucher IT 40P Step 10: Detach the form from the instruction portion on the top along the dotted line.

Ohio Income Tax Payment Voucher IT 40P Step 11: Make your personal check or money order payable to "Ohio Treasurer of State." On this check or money order, be sure to include your Social Security number and the taxable year for which you are filing.

Ohio Income Tax Payment Voucher IT 40P Step 12: Do not attach the check or money order to form IT 40P when mailing, but put them separately in the same envelope.