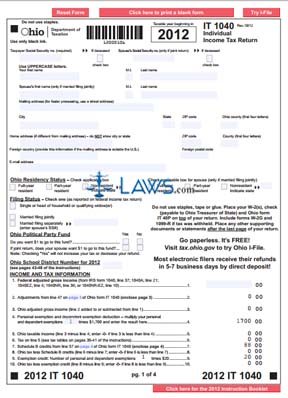

Form IT 1040 Ohio Individual Income Tax Return

INSTRUCTIONS: OHIO INDIVIDUAL INCOME TAX RETURN (Form IT 1040)

Ohio residents, part-year residents and non residents can all use a form IT 1040 to file income tax due to the state. This document can be obtained from the website maintained by the Ohio Department of Taxation.

Ohio Individual Income Tax Return IT 1040 Step 1: Enter your name and Social Security number, as well as the same information for your spouse if filing jointly.

Ohio Individual Income Tax Return IT 1040 Step 2: Enter your mailing address, as well as your home address if different from your mailing address.

Ohio Individual Income Tax Return IT 1040 Step 3: Indicate your residency status with a check mark. Do the same for your spouse if filing jointly.

Ohio Individual Income Tax Return IT 1040 Step 4: Indicate your filing status with a check mark. If married but filing separately, enter your spouse's Social Security number.

Ohio Individual Income Tax Return IT 1040 Step 5: Indicate whether or not you wish to donate a dollar to the Ohio Political Party Fund.

Ohio Individual Income Tax Return IT 1040 Step 6: Enter your Ohio school district number.

Ohio Individual Income Tax Return IT 1040 Step 7: Enter your federal adjusted gross income on line 1.

Ohio Individual Income Tax Return IT 1040 Step 8: Calculate your net adjustments on Schedule A, which is on the third page of this form, then transfer the result from line 47 there to line 3 on the first page.

Ohio Individual Income Tax Return IT 1040 Step 9: Add or subtract lines 1 and 2 as appropriate and enter the result on line 3.

Ohio Individual Income Tax Return IT 1040 Step 10: Complete lines 4 through 10 as instructed to determine your Ohio tax less exemption credit. Note that to complete lines 7 and 8, you must first complete Schedule B, which is located on the fourth page.

Ohio Individual Income Tax Return IT 1040 Step 11: Complete lines 10a through 22 to calculate your total payments.

Ohio Individual Income Tax Return IT 1040 Step 12: Complete lines 23 through 30 to determine the amount you owe or the refund you are owed.

Ohio Individual Income Tax Return IT 1040 Step 13: Sign and date the bottom of the second page.