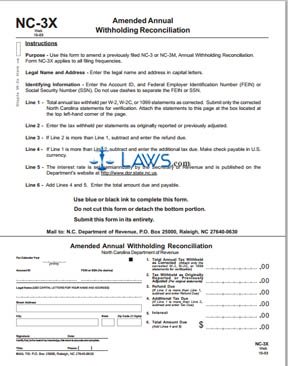

Form NC-3X Amended Annual Withholding Reconciliation

INSTRUCTIONS: NORTH CAROLINA AMENDED ANNUAL WITHHOLDING RECONCILIATION (Form NC-3X)

North Carolina businesses who need to amend their original annual withholding reconciliation do so by filing a form NC-3X. This document can be obtained from the website maintained by the North Carolina Department of Revenue.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 1: Enter the calendar year for which you are filing on the first line on the left.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 2: On the second line, enter your account ID.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 3: On the third line, enter your federal employer identification number or Social Security number.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 4: On the fourth line, enter the legal name of your business in capital letters.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 5: On the fifth line, enter your street address in capital letters.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 6: On the sixth line, enter your city.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 7: On the seventh line, enter your state.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 8: On the eighth line, enter your zip code.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 9: On line 1, enter the total annual tax withheld as corrected. Attach the corrected W-2, W-2C or 1099 for verification.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 10: On line 2, enter the tax withheld as originally reported or last adjusted.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 11: If line 2 is greater than line 1, enter the difference on line 3. This is the refund you are owed.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 12: If line 1 is greater than line 1, enter the difference on line 4. This is the additional tax due.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 13: Enter any interest due for late payments on line 5.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 14: Add lines 5 and 6. Enter the resulting sum on line 6. This is your total amount due.

North Carolina Amended Annual Withholding Reconciliation NC-3X Step 15: Sign and date the first line at the bottom left of the page. Enter your title and phone number on the second line.