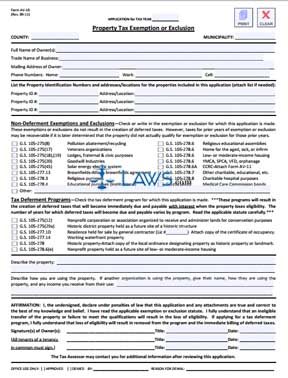

INSTRUCTIONS: NORTH CAROLINA PROPERTY TAX EXEMPTION OR EXCLUSION (Form AV-10)

North Carolina non-profit organizations and various other companies may file a form AV-10 seeking an exemption from paying property tax. This application form is available on the website of the North Carolina Department of Revenue.

North Carolina Property Tax Exemption Or Exclusion AV-10 Step 1: At the top of the page, enter the tax year you are filing in and the name of the county and municipality in which you are filing.

North Carolina Property Tax Exemption Or Exclusion AV-10 Step 2: In the first section below this, enter the trade name of the business, the name or names of all business owners, their mailing address, and their home, work and cell phone numbers.

North Carolina Property Tax Exemption Or Exclusion AV-10 Step 3: The next section requires you to give the property identification numbers, addresses and locations of all property you are seeking an exemption or exclusion for. Attach an additional list if necessary.

North Carolina Property Tax Exemption Or Exclusion AV-10 Step 4: The next section is only to be completed if seeking an exemption or exclusion. Organizations which qualify for an exemption or exclusion are listed. Place a check mark next to the statement which describes your business. Those listed involved pollution abatement or recycling companies, religious and educational businesses, nursing homes, veterans organizations, solar energy businesses, and charitable medical care. If none of these apply to your business, check "other" and provide a written explanation.

North Carolina Property Tax Exemption Or Exclusion AV-10 Step 5: The next section should only be completed if seeking to enroll in a tax deferment program. This means that your taxes will be deferred but become immediately due if you lose your eligibility status. Check the box next to the statement describing your organization. The listed organizations which are eligible include nonprofit corporations or associations that work with land conservation, historic district properties being held for a future historic structure, residences held for sale by a general contractor, working waterfront properties, historic properties, or nonprofit property reserved for low or moderate income housing.

North Carolina Property Tax Exemption Or Exclusion AV-10 Step 6: Describe the property and how it is used. If another organization is using it, give their name, describe their activities and note any income you receive from them. All owners must sign and date the form.