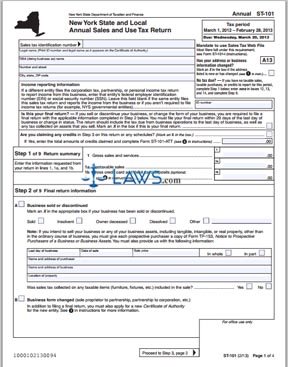

Form ST-101 Local Annual Sales and Use Tax Return

INSTRUCTIONS: NEW YORK STATE AND LOCAL ANNUAL SALES AND USE TAX RETURN (Form ST-101)

New York state businesses must submit reports of their sales and use tax payments owed. Most businesses are required to submit this form online if they do not use a tax preparer, prepare their documents on a computer and have broadband internet access. This article discusses the paper version of the ST-101 filed by businesses which do not meet these requirements and owe $3,000 or less in total tax due for a year-long period.

New York State And Local Annual Sales And Use Tax Return ST-101 Step 1: On the line labeled "Step 1," enter your total gross sales and services earned in the past year rounded to the nearest whole dollar.

New York State And Local Annual Sales And Use Tax Return ST-101 Step 2: On the line labeled "Step 2," seven attachment forms are listed that must be filed by people who meet various qualifications. Review these to see if any apply to your business.

New York State And Local Annual Sales And Use Tax Return ST-101 Step 3: In the section labeled "Step 3," you must calculate the sales and use tax owed. Do this by entering your taxable sales and services in Column C, your purchase subject to tax in Column D, and then multiplying the combined total by the tax rate for your county or sub-area. Only do so on the line assigned for your county or sub-area.

New York State And Local Annual Sales And Use Tax Return ST-101 Step 4: Enter the total number of credits you are labeling at the bottom of "Step 3."

New York State And Local Annual Sales And Use Tax Return ST-101 Step 5: "Step 4" concerns three special taxes levied on passenger car rental services and entertainment and information services delivered through telephony and telegraphy.

New York State And Local Annual Sales And Use Tax Return ST-101 Step 6: In "Step 5," follow instructions to calculate your tax credits and advance payments. Do the same to calculate your taxes owed in "Step 6," your vendor collection credit or penalty and interest due in "Step 7," and the total due in "Step 8."

New York State And Local Annual Sales And Use Tax Return ST-101 Step 7: Sign the bottom of the form and provide all information requested.