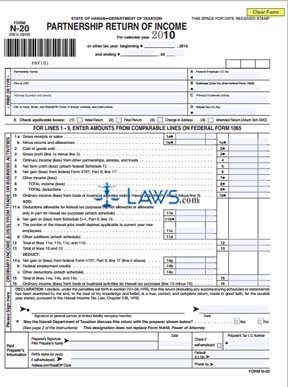

Form N20 Partnership Tax Return

INSTRUCTIONS: HAWAII PARTNERSHIP RETURN OF INCOME (Form N-20)

Partnerships doing business in Hawaii file their state documentation of their income returns using a form N-20. The document can be obtained from the website of the government of Hawaii. You will need a copy of your federal form 4797 to complete this form.

Hawaii Partnership Return Of Income N-20 Step 1: At the top left of the form, enter your partnership name, trade name, address, city state and zip code.

Hawaii Partnership Return Of Income N-20 Step 2: Enter your federal employer identification number in box A, your business code number in box B, your principal business activity in box C, your state tax ID number in box D.

Hawaii Partnership Return Of Income N-20 Step 3: On line E, indicate with a check mark if filing an initial, amended or final return, or one documenting a change in address.

Hawaii Partnership Return Of Income N-20 Step 4: On line 1a, enter your gross receipts or sales. On line 1b, enter your returns and allowances.

Hawaii Partnership Return Of Income N-20 Step 5: Subtract line 1b from line 1a. Enter the resulting difference on line 1c.

Hawaii Partnership Return Of Income N-20 Step 6: Enter the cost of goods sold on line 2.

Hawaii Partnership Return Of Income N-20 Step 7: Subtract line 2 from line 1c. Enter the resulting difference on line 3.

Hawaii Partnership Return Of Income N-20 Step 8: Document other income as instructed on lines 4 through 7 and total your income on line 8.

Hawaii Partnership Return Of Income N-20 Step 9: Enter your total deductions on line 9. Subtract this from line 8 and enter the resulting difference on line 10.

Hawaii Partnership Return Of Income N-20 Step 10: Follow the directions on lines 11a through 13 to document and total your additions.

Hawaii Partnership Return Of Income N-20 Step 11: Follow the directions on lines 14 and 15 to document your deductions. Your final adjusted ordinary business income or loss will be calculated on line 16.

Hawaii Partnership Return Of Income N-20 Step 12: A general partner or limited liability company member should sign and date the bottom of the first page.

Hawaii Partnership Return Of Income N-20 Step 13: On the second page, document partners' pro rata share items as directed in Schedule K.