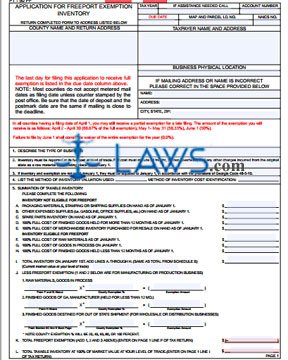

Form PT-50PF Application For Freeport Exemption Inventory

INSTRUCTIONS: GEORGIA APPLICATION FOR FREEPORT EXEMPTION INVENTORY (Form PT-50F)

Georgia businesses may file a form PT-50F to seek a tax exemption for certain eligible parts of their inventory, such as raw goods used in the manufacturing of products for sale, goods in process and finished goods held for less than a year. A full explanation of which parts of inventory are eligible for a freeport exemption can be found on the second page of this form. The document can be found on the website of the Georgia Department of Revenue.

Georgia Application For Freeport Exemption Inventory PT-50F Step 1: At the top right corner of the first page, enter the tax year, your account number, the due date of the form, the map and parcel identification numbers assigned to your business property and the NAICS number classification assigned to your business.

Georgia Application For Freeport Exemption Inventory PT-50F Step 2: Enter the county name and the return address where the form is filed where indicated. Enter the name and address of the taxpayer on the right where indicated.

Georgia Application For Freeport Exemption Inventory PT-50F Step 3: Enter your mailing address or address where indicated if the sticker provided for your business by the Department of Revenue is inaccurate.

Georgia Application For Freeport Exemption Inventory PT-50F Step 4: On line 1, describe your business. On line 4, list the method of your inventory valuation and of your inventory cost identification.

Georgia Application For Freeport Exemption Inventory PT-50F Step 5: Lines 5a through 5e require you to list inventory not eligible for a freeport exemption, including packaging materials, spare parts inventory and finished goods held onto for more than a year.

Georgia Application For Freeport Exemption Inventory PT-50F Step 6: Lines 5f through 5h require you to list inventory eligible for a freeport exemption.

Georgia Application For Freeport Exemption Inventory PT-50F Step 7: Complete the calculations as instructed in lines 5i through 5l to determine the market value of your total taxable inventory.

Georgia Application For Freeport Exemption Inventory PT-50F Step 8: Section 6c is for wholesale distribution businesses only.

Georgia Application For Freeport Exemption Inventory PT-50F Step 9: List the physical location of the inventory in section 8, the location of your records in section 9, and contact information in case of questions in section 10. The taxpayer should sign and date the form and give their title.