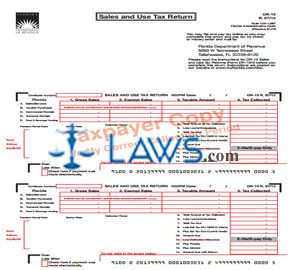

Form DR-15 Sales and Use Tax Return

INSTRUCTIONS: FLORIDA SALES AND USE TAX RETURN (Form DR-15)

Florida businesses document the sales and use tax owed to the state by filing a form DR-15. This form is found on the website of the Florida Department of Revenue.

Florida Sales And Use Tax Return DR-15 Step 1: There are two copies of this return on the same page. The top copy, as labeled, is for your records and should not be submitted to the Department of Revenue. Complete and submit both halves, and send the bottom half to the Department of Revenue.

Florida Sales And Use Tax Return DR-15 Step 2: At the top left-hand corner, enter your business certificate number.

Florida Sales And Use Tax Return DR-15 Step 3: On line A, enter your total sales and service grosses. Enter the gross value earned in column 1 and the exempt sales in column 2. Subtract column 2 from column 1 to determine your total taxable amount in column 3. Enter the tax collected in column 4. On line B, enter your total taxable purchases under column 3. Include internet and out-of-state purchases of tangible personal property. Enter the tax collected on these under column 4.

Florida Sales And Use Tax Return DR-15 Step 4: On line C, provide all information about revenues from commercial rentals and perform the calculations as in step 3 in all four columns. On line D, do the same for revenues from transient rentals. On line E, do the same for revenues from food and beverage vending.

Florida Sales And Use Tax Return DR-15 Step 5: Enter the total tax collected on line 5.

Florida Sales And Use Tax Return DR-15 Step 6: Enter your lawful deductions on line 6. Subtract this from line 5 and enter the difference on line 7. If you paid estimated tax or have credit from a previous return, enter this on line 8. On line 9, enter the estimated tax due at the end of the current month. Subtract line 8 from line 7, add line 9, and enter the result on line 10.

Florida Sales And Use Tax Return DR-15 Step 7: If you are filing or paying late, visit the website of the Florida Department of Revenue to learn how to calculate your interest and penalty owed on lines 12 and 13. Enter your total due on line 14.