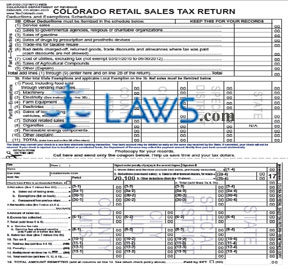

Form DR0100F Retail Sales Tax Return 2011

INSTRUCTIONS: COLORADO RETAIL SALES TAX RETURN (Form DR 0100)

All Colorado retailers must submit a form DR 0100 documenting their sales tax collected. This document can be obtained from the website of the government of the state of Colorado.

Colorado Retail Sales Tax Return DR 0100 Step 1: The form contains a worksheet for your records and a return to be mailed to the Department of Revenue. Detach the two along the dotted line.

Colorado Retail Sales Tax Return DR 0100 Step 2: Complete the worksheet first. Calculate your revenue, deductions and exemptions as instructed.

Colorado Retail Sales Tax Return DR 0100 Step 3: On the return, give the date, your business phone number, the location or jurisdiction code, the due date for this form, your account number, and the period for which you are filing. If filing an amended return, check the box indicating this. Sign the form at the top right.

Colorado Retail Sales Tax Return DR 0100 Step 4: On line 1, enter your total gross from sales and services. On line 2a, enter your total sales to other retailers for resale. On line 2b, enter all other deductions. Give the total of these two lines on line 2c. Subtract line 2c from line 1. Enter the result on line 3.

Colorado Retail Sales Tax Return DR 0100 Step 5: On line 3a, give your sales outside of the taxing area. On line 3b, give your exemptions and list them on the back. On line 3c, give any overpayment from a total return. Subtract the sum of lines 3a through 3c from line 3 and enter the difference on line 4.

Colorado Retail Sales Tax Return DR 0100 Step 6: On line 5, give the amount of sales tax due. On line 6, enter any excess tax collected. Add the two number and enter the sum on line 7.

Colorado Retail Sales Tax Return DR 0100 Step 7: On line 8a, enter the service fee rate. If paying on or before the due date, complete line 8b. Subtract this from line 7 and enter the difference on line 9 to determine your sales tax due. Enter any goods purchased but taken out of stock and compute the tax due on line 10. Add lines 9 and 10 and enter the total on line 11. If paying late, complete lines 11 through 14.