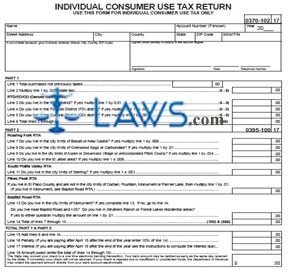

Form DR 1306 Individual Consumer Use Tax Return

INSTRUCTIONS: COLORADO INDIVIDUAL CONSUMER USE TAX RETURN (Form DR 1306)

Colorado individuals who made purchases without paying sales tax, such as over the internet or by phone, must submit a form DR 1306 in order to pay the use tax owed. This form is found on the official website of the state of Colorado.

Colorado Individual Consumer Use Tax Return DR 1306 Step 1: The first section of this form requires your name, account number (if known), the year, your street address and county, and your Social Security or Individual Taxpayer Identification Number. If an out-of-state resident, give your Colorado address.

Colorado Individual Consumer Use Tax Return DR 1306 Step 2: Sign and date this first section. Provide your telephone number.

Colorado Individual Consumer Use Tax Return DR 1306 Step 3: On line 1, enter the sum of purchases that were not previously taxed. Multiply this sum by .029 to determine the state tax owed on line 2.

Colorado Individual Consumer Use Tax Return DR 1306 Step 4: If you live in one of the state's four Rural Transit Authority districts, multiply line 1 by .001 to determine the tax owed on line 3. Otherwise, leave the line blank.

Colorado Individual Consumer Use Tax Return DR 1306 Step 5: If you live in the Football District of Denver, multiply line 1 by .001 to determine your tax owed on line 4. Multiply line 1 by the same percentage to determine the tax owed if you live in the Cultural District of Denver on line 5.

Colorado Individual Consumer Use Tax Return DR 1306 Step 6: Enter the totals of lines 2 through 5 to determine your total use tax owed on line 6.

Colorado Individual Consumer Use Tax Return DR 1306 Step 7: Part 2 should only be completed if you live in one of the RTA districts. If so, complete the section applying to Roaring Fork, South Platte Valley, Pikes Peak or Baptist Road as applicable.

Colorado Individual Consumer Use Tax Return DR 1306 Step 8: Add the totals of lines 6 and 14. Enter this total tax owed on line 15.

Colorado Individual Consumer Use Tax Return DR 1306 Step 9: If you are filing after April 15, multiply line 14 by 10% to determine your penalty on line 16 and follow instructions to determine interest owed on line 17. Enter the total owed on line 18.