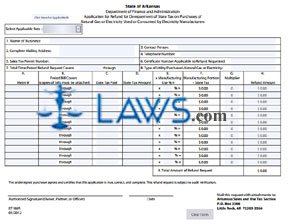

Electricity Manufacturing Utility Reduced Tax Refund Request ET-186 R

INSTRUCTIONS: ARKANSAS ELECTRICITY MANUFACTURING UTILITY REDUCED TAX REFUND REQUEST (Form ER-186 R)

Arkansas electricity manufacturers who have overpaid state tax on the purchase of natural gas or electricity used or consumed as part of their operations can apply for a refund using a form ER-186 R. This document can be obtained from the website of the Arkansas Department of Finance and Administration.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 1: In the first box, enter the applicable rate.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 2: In box 1, enter the name of your business.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 3: In box 2, enter your complete business mailing address.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 4: In box 3, enter the name of a contact person.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 5: In box 4, enter a contact telephone number.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 6: In box 5, enter your sales tax permit number.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 7: In box 6, enter the certificate number applicable to the refund requested.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 8: In box 7, enter the beginning and ending dates of the total time period covered in your refund request.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 9: In box 8, enter whether you purchased natural gas or electricity.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 10: In column A of the table below, enter the meter number monitoring each purchase. Enter the beginning and ending dates of each bill in column B. In column C, enter the date on which tax was paid.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 11: In box D, enter the state tax amount. In column E, enter the percentage of manufacturing use. Multiply columns D and E and enter the product in column F. Enter your multiplier in column G and your refund owed in column H. Enter the total refund requested where indicated.

Arkansas Electricity Manufacturing Utility Reduced Tax Refund Request ER-186 R Step 12: Sign and date the bottom of the form.