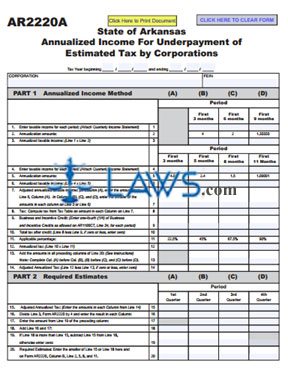

AR2220A Annualized Income for Underpayment of Estimated Tax

INSTRUCTIONS: ARKANSAS ANNUALIZED INCOME FOR UNDERPAYMENT OF ESTIMATED TAX BY CORPORATIONS (Form AR220A)

Corporations which underpay their estimated tax in Arkansas may be able to compute the penalty owed on an annualized basis. This is done using a form AR220A. This document can be obtained from the website maintained by the Arkansas Department of Finance and Administration.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 1: Enter the beginning and ending dates of your tax year.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 2: Enter the name of your corporation.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 3: Enter your federal employer identification number.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 4: On line 1, enter your taxable period for all four quarters in the appropriate columns.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 5: On line 2, enter your annualization amounts.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 6: Multiply line 1 by line 2. Enter the resulting product on line 3.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 7: Enter your taxable income for each quarter on line 4.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 8: Enter your annualization amounts on line 5.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 9: Multiply line 4 by line 5. Enter the resulting product on line 6.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 10: On line 7, enter the amount from column A of line 6 in column A. In columns B, C and D, enter the smaller of the amounts in the corresponding column from either line 3 or line 6.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 11: Use the tax table to compute your tax owed on line 8.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 12: Complete lines 9 through 14 as instructed to determine your adjusted annualized tax.

Arkansas Annualized Income For Underpayment Of Estimated Tax By Corporations AR220A Step 13: Complete lines 15 through 20 as instructed to determine your required estimates.