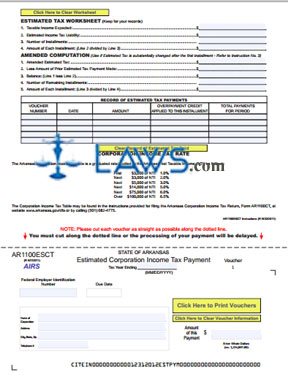

AR1100ESCT Estimated Tax Declaration Vouchers

INSTRUCTIONS: ARKANSAS CORPORATION INCOME TAX ESTIMATED TAX DECLARATION VOUCHERS (Form AR1100ESCT)

To file Arkansas corporation estimated income tax payments, a form AR1100ESCT should be used. This document can be obtained from the website maintained by the Arkansas Department of Finance and Administration.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 1: The first page contains instructions.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 2: The top of the second page contains an estimated tax worksheet for your records. On line 1, enter your expected taxable income.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 3: On line 2, enter your estimated income tax liability.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 4; On line 3, enter the number of installments.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 5: Divide line 2 by line 3. Enter the resulting figure on line 4.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 6: If your estimated tax changes substantially after the first installment, you should complete the Amended Computation section.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 7: In the table provided below, record your estimated tax payments. Enter the voucher number of each payment in the first column, the date in the second column, the amount of the payment in the third column, the overpayment credit to be applied to the installment in the fourth column, and the total payments for the period in the fifth column.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 8: On the voucher, enter your federal employer identification number in the first blank box.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 9: In the second blank box, enter your due date.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 10: In the third blank box, enter the name of your corporation.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 11: In the fourth blank box, enter your street address.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 12: In the fifth blank box, enter your city, state and zip code.

Arkansas Corporation Income Tax Estimated Tax Declaration Vouchers AR1100ESCT Step 13: In the sixth blank box, enter your telephone number. In the seventh blank box, enter the amount of the payment being submitted.