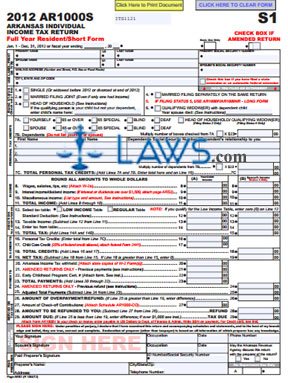

AR1000S Full Year Resident Short Form Income Tax Return

INSTRUCTIONS: ARKANSAS INDIVIDUAL INCOME TAX RETURN FULL YEAR RESIDENT/SHORT FORM (Form AR1000S)

Full-year Arkansas residents who meet the income requirements associated with form AR1000S may file this short form individual income tax return. This document can be obtained from the website maintained by the Arkansas Department of Finance and Administration.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 2: In the first section enter your name, Social Security number and mailing address. If filing jointly with your spouse, provide their name and Social Security number as well.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 3: Indicate your filing status on lines 1 through 5 by checking the box next to the appropriate statement.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 4: Document exemptions being claimed and dependents on lines 7A through 7C as instructed.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 5: On lines 8 through 11, document your total income as instructed. Note that if you have over $1,500 in interest and dividends to document on line 9, you must complete the charts on the second page (sub-form S2) and attach it when filing.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 6: On lines 12 through 15, calculate your total tax liability as instructed.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 7: On lines 16 through 18, calculate your total credits as instructed.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 8: Subtract line 18 from line 15. Enter the resulting difference on line 19. This is your net tax owed.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 9: Complete lines 20 through 25 as instructed to calculate your adjusted total payments.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 10: Complete lines 26 through 29 to determine your final amount due.

Arkansas Individual Income Tax Return Full Year Resident/Short Form AR1000S Step 11: Sign and date the form.