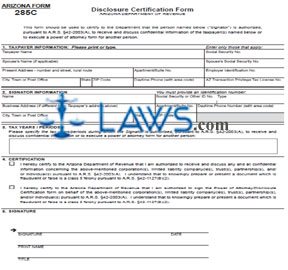

Form 285C Disclosure Certification Form

INSTRUCTIONS: ARIZONA DISCLOSURE CERTIFICATION FORM (Form 285C)

An Arizona form 285C is used to certify that you are authorized to receive and discuss confidential tax information on behalf of another taxpayer or that you are authorized to execute power of attorney on their behalf in these matters. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Disclosure Certification Form 285C Step 1: Section 1 concerns the taxpayer. Enter their name in the first blank box.

Arizona Disclosure Certification Form 285C Step 2: Enter the taxpayer's spouse's name, if applicable, in the second blank box.

Arizona Disclosure Certification Form 285C Step 3: Enter the taxpayer's present street address in the third blank box.

Arizona Disclosure Certification Form 285C Step 4: If applicable, enter the taxpayer's apartment or suite number in the fourth blank box.

Arizona Disclosure Certification Form 285C Step 5: In the next four blank boxes, enter the taxpayer's city, town or post office, state, zip code and daytime phone number.

Arizona Disclosure Certification Form 285C Step 6: As applicable, provide the taxpayer's Social Security number, their spouse's Social Security number, the taxpayer's employer identification number or their Arizona transaction privilege tax license number.

Arizona Disclosure Certification Form 285C Step 7: Section 2 concerns the authorized signator. Enter your name in the first blank box.

Arizona Disclosure Certification Form 285C Step 8: Enter your business address, if different from the taxpayer's address provided above, in the second blank box.

Arizona Disclosure Certification Form 285C Step 9: In the next three blank boxes, provide your city, town or post office, state and zip code.

Arizona Disclosure Certification Form 285C Step 10: Enter your Social Security number or other identification number and daytime phone number.

Arizona Disclosure Certification Form 285C Step 11: In section 3, enter the tax years or periods for which you are authorized to receive and discuss confidential tax information.

Arizona Disclosure Certification Form 285C Step 12: Check the box next to the first statement in section 4 if authorized to receive and discuss confidential tax information for the years or periods specified in section 3. Check the box next to the second statement if you are authorized with power of attorney regarding these tax matters.

Arizona Disclosure Certification Form 285C Step 13: Sign and date section 5, as well as printing your name and entering your title.