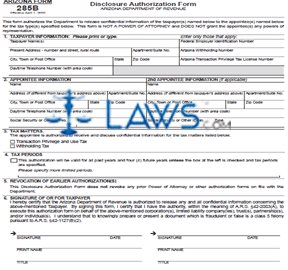

Form 285B Disclosure Authorization

INSTRUCTIONS: ARIZONA DISCLOSURE AUTHORIZATION FORM (Form 285B)

To authorize another person to receive confidential tax forms relating to tax payments in Arizona without giving that person power of attorney to represent you, you may use a form 285B. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Disclosure Authorization Form 285B Step 1: Section 1 requires information about the taxpayer. Enter your name, that of your spouse if applicable, your present street address, city, town or post office, state, zip code, and daytime phone number with area code.

Arizona Disclosure Authorization Form 285B Step 2: Section 1 also requires you to enter any of the following applicable information: your Social Security number, your spouse's Social Security number, your employer identification number, and/or your Arizona transaction privilege tax license number.

Arizona Disclosure Authorization Form 285B Step 3: Section 2 requires you to give information for up to two appointees. Enter the first appointee's name, address (if different from yours), city, town or post office, state, zip code, daytime telephone number, and their Social Security number or other identifying number. Enter the name of the type of identifying number you have entered.

Arizona Disclosure Authorization Form 285B Step 4: Enter all the same information for a second appointee if you wish to authorize a second person in this capacity.

Arizona Disclosure Authorization Form 285B Step 5: Section 3 concerns the type of tax information your appointees are authorized to receive documentation concerning. The first category is income tax. Enter the years or periods for which your appointees are eligible to receive this information, and check the box next to any or all of the six types of returns they are authorized to receive.

Arizona Disclosure Authorization Form 285B Step 6: The second category is transaction privilege and use tax. Enter the years or periods for which your appointees are eligible to receive this information and check the box next to any or all of the seven types of returns they are authorized to receive.

Arizona Disclosure Authorization Form 285B Step 7: The third category is withholding tax. Check the box next to this if applicable. The last category is "other." You must specify the type of taxes and the returns which can be released.

Arizona Disclosure Authorization Form 285B Step 8: Sign and print your name and enter the date in section 5.