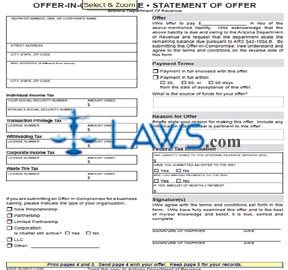

Form 20-0001f Offer-in-Compromise Booklet

INSTRUCTIONS: ARIZONA OFFER-IN-COMPROMISE BOOKLET (Form 20-001)

When unable to pay your Arizona taxes in a timely fashion, you may file a form 20-001 to present an offer in compromise of what you can afford to pay. This document can be obtained as part of a booklet from the website of the Arizona Department of Revenue. The form is printed on the fourth page of the booklet.

Arizona Offer-In-Compromise Booklet 20-001 Step 1: Enter the name of the taxpayer, the business "doing business as" name or corporate name in the first blank box.

Arizona Offer-In-Compromise Booklet 20-001 Step 2: Enter your street address in the second blank box.

Arizona Offer-In-Compromise Booklet 20-001 Step 3: Enter your city, state and zip code in the third blank box.

Arizona Offer-In-Compromise Booklet 20-001 Step 4: Enter your mailing address, if different from the above, in the fourth blank box.

Arizona Offer-In-Compromise Booklet 20-001 Step 5: Enter your mailing city, state and zip code, if applicable, in the fifth blank box.

Arizona Offer-In-Compromise Booklet 20-001 Step 6: In the next blank box, enter your Social Security number and the amount owed in individual income tax.

Arizona Offer-In-Compromise Booklet 20-001 Step 7: In the next blank box, if applicable, enter your spouse's Social Security number.

Arizona Offer-In-Compromise Booklet 20-001 Step 8: In the next blank box, enter your transaction privilege tax license number and amount owed.

Arizona Offer-In-Compromise Booklet 20-001 Step 9: In the next blank box, enter your withholding tax license number and the amount owed.

Arizona Offer-In-Compromise Booklet 20-001 Step 10: In the next blank box, enter your corporate income tax license number and amount owed.

Arizona Offer-In-Compromise Booklet 20-001 Step 11: In the next blank box, enter your waste tire tax license number and amount owed.

Arizona Offer-In-Compromise Booklet 20-001 Step 12: If submitting this offer for a business liability, indicate the type with a check mark.

Arizona Offer-In-Compromise Booklet 20-001 Step 13: In the section labeled "Offer," enter the amount you are able to pay.

Arizona Offer-In-Compromise Booklet 20-001 Step 14: Indicate your payment terms with check marks next to the applicable statements.

Arizona Offer-In-Compromise Booklet 20-001 Step 15: Enter the reason for your offer where indicated.

Arizona Offer-In-Compromise Booklet 20-001 Step 16: Provide all federal tax information required. Enter your signature and the date at the bottom of the page.