Form 140 Resident Personal Income Tax Return Booklet

INSTRUCTIONS: ARIZONA RESIDENT PERSONAL INCOME TAX BOOKLET (Form 140)

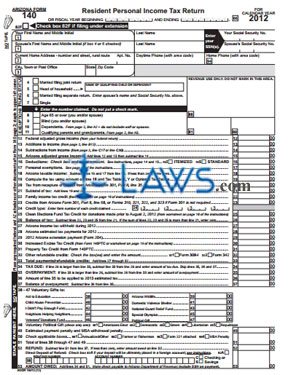

Arizona residents can use a form 140 to file their personal state income tax due. This article discusses the booklet made available on their website by the Arizona Department of Revenue containing detailed instructions for completion and supplemental forms.

Arizona Resident Personal Income Tax Booklet 140 Step 1: The first page is a cover page.

Arizona Resident Personal Income Tax Booklet 140 Step 2: The second and third pages contain changes regarding donations to various citizens funds.

Arizona Resident Personal Income Tax Booklet 140 Step 3: The fourth page contains an overview of new changes and items of interest concerning form 140.

Arizona Resident Personal Income Tax Booklet 140 Step 4: The fifth page has intentionally been left blank.

Arizona Resident Personal Income Tax Booklet 140 Step 5: Pages 5 through 7 contain general instructions for completion of this form.

Arizona Resident Personal Income Tax Booklet 140 Step 6: Detailed line-by-line instructions for completion of form 140 begin on page 8 and continue through page 19, covering up to line 25.

Arizona Resident Personal Income Tax Booklet 140 Step 7: Page 19 contains contact information for further assistance in completion of form 140.

Arizona Resident Personal Income Tax Booklet 140 Step 8: Pages 20 and 21 contain form 140.

Arizona Resident Personal Income Tax Booklet 140 Step 9: Pages 22 and 23 contain a duplicate copy of form 140.

Arizona Resident Personal Income Tax Booklet 140 Step 10: Page 24 contains Schedule A, which is to be completed for those claiming itemized deduction adjustments.

Arizona Resident Personal Income Tax Booklet 140 Step 11: Page 25 contains instructions for completing Schedule A.

Arizona Resident Personal Income Tax Booklet 140 Step 12: Page 26 contains form 204, used to apply for a filing extension.

Arizona Resident Personal Income Tax Booklet 140 Step 13: Page 27 contains instructions for completion of form 204.

Arizona Resident Personal Income Tax Booklet 140 Step 14: Page 28 summarizes available tax credits.

Arizona Resident Personal Income Tax Booklet 140 Step 15: Page 29 has been intentionally left blank.

Arizona Resident Personal Income Tax Booklet 140 Step 16: Line-by-line instructions resume on page 30 and continue through page 38. The remainder of the form contains tax tables for computation purposes, as well as a table of contents.