Form 20-E Corporate Income Tax Estimated and Extension

INSTRUCTIONS: ALABAMA ESTIMATED TAX (Form CD)/PAYMENT VOUCHER AND EXTENSION REQUEST (Form E)

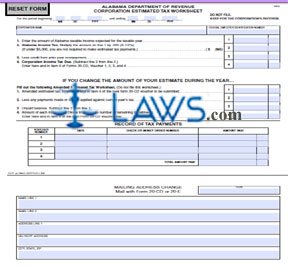

Alabama corporations required to file a corporate return must annually file an estimated tax form (form CD) if their tax liability is expected to be $5,000 or greater and must pay at least 25% of their tax at this time. Corporations which need more time to file their return should file a form E to confirm they have submitted payment and request a filing extension. This article discusses both forms, which are made available as one package on the website of the Alabama Department of Revenue.

Alabama Estimated Tax CD/Payment Voucher Extension Request E Step 1: The first page of this document consists of instructions for form CD. The second page contains a worksheet to establish your estimated tax liability. This is your records and should not be mailed to the Department of Revenue.

Alabama Estimated Tax CD/Payment Voucher Extension Request E Step 2: If your business mailing address has changed since your last filing, cut off the bottom of page two. Enter all information requested under "Mailing Address Change" and submit it with your form CD or form E.

Alabama Estimated Tax CD/Payment Voucher Extension Request E Step 3: Form CD is located on the third page of this package. Enter all information requested about your tax liability, address and other details.

Alabama Estimated Tax CD/Payment Voucher Extension Request E Step 4: Form E grants an extension of six months to file a corporate tax return with the state. You do not need to file this document if you have been granted a federal tax extension.

Alabama Estimated Tax CD/Payment Voucher Extension Request E Step 5: From E is located on the last page of this package and should be separated from the rest of the page along the dotted line.

Alabama Estimated Tax CD/Payment Voucher Extension Request E Step 6: On Form E, enter all information requested about your business, your liability and the amount of the payment being remitted with this form. A corporation officer or authorized agent must sign the form.

Alabama Estimated Tax CD/Payment Voucher Extension Request E Step 7: Note that all payments of $25,000 or more must be submitted via an electronic funds transfer (EFT).